The impact of credit expansion on Brazilian agribusiness

Seguro Rural Brasil

Sep 19, 2024

A study conducted by Rivool Finance reveals the importance of credit availability in the agricultural production growth of more than 4,000 Brazilian municipalities.

A study by Rivool Finance, a web3 fintech, details the relationship between different credit models and the expansion of Brazilian agribusiness. Through an extensive analysis covering 4,618 municipalities from 2013 to 2021, the study used sophisticated econometric methods, specifically a Vector Autoregression (VAR) model with panel data, to investigate the relationship between credit expansion and agricultural production growth.

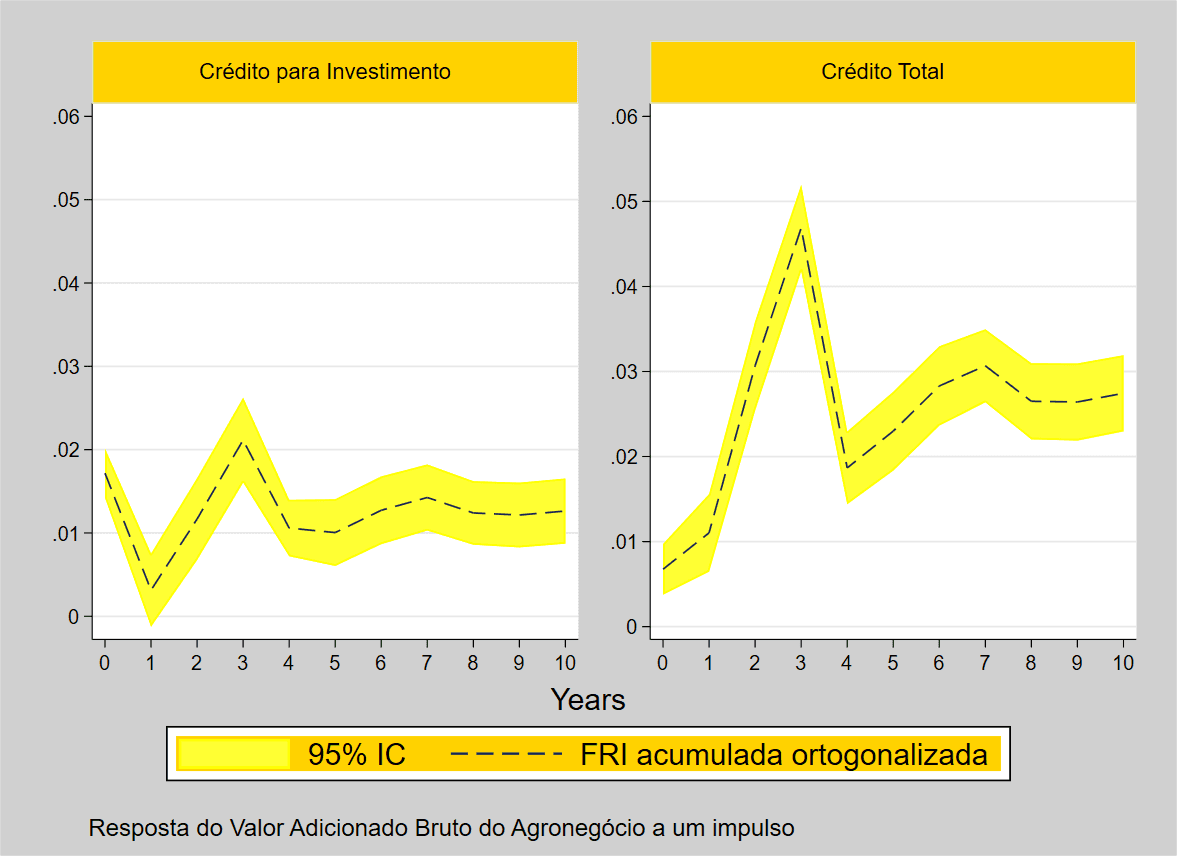

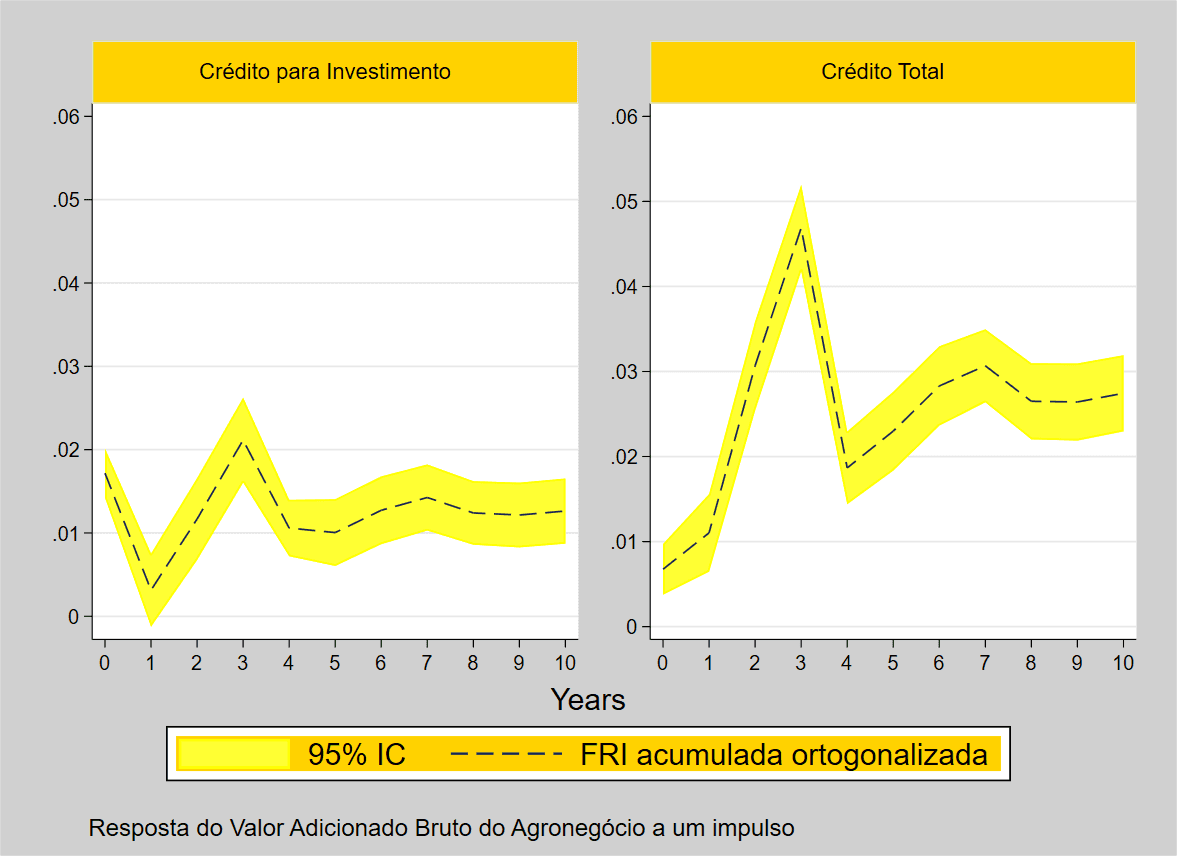

Over three years, a 10% increase in total credit volume directly contributed to a 1.8% rise in agribusiness production, corresponding to a 4.88% production growth in response to a standard deviation in total credit. This demonstrates the stimulating effect of credit on the sector. The findings highlight the critical role of credit availability in driving agricultural production growth and underscore the importance of financial support for sustainable sector development.

The Rivool study analyzed different types of credit (working capital, investment, commercialization, and industrialization), emphasizing that increased investment credit volume accounted for approximately 0.7% of the observed agricultural production growth. The other credit types showed no statistically significant impact. The results provide a novel perspective, revealing that credit expansion accompanies and precedes production increases in the municipalities analyzed.

The research is part of Rivool Finance's Market Review, led by Cristiano Oliveira, Head of Research at Rivool Finance and a Federal University of Rio Grande professor. "We are witnessing a significant shift in the Brazilian agribusiness landscape. Traditionally, rural credit resources in Brazil came largely from the public budget, through constitutional funds, and primarily from earmarked resources of demand deposits and rural savings accounts. Public budget constraints and limited resources available at traditional financial institutions have started to pose serious challenges to the sector's dynamic expansion," Oliveira points out.

In response to this challenge, Brazil saw the implementation of fundamental legislative changes, enacting Law 13,986/2020 and Law 14,421/2022, known as Agro 1 and Agro 2, respectively. The Rivool study's findings make it clear that these laws mark a turning point in the history of rural credit in the country, setting a new paradigm for agribusiness financing. The impact of these laws on Brazilian agribusiness has been significant, allowing the sector to continue its expansion trajectory in line with growing global demand.

These changes and the ability to securitize foreign currency receivables enabled by Law 13,986/2020 and the creation of Fiagro under Law 14,130/2021 have effectively opened Brazilian agribusiness to national and international capital markets. The new reality is evident in the numbers. Since the enactment of Agro Law 1 in 2020, CPRs (Rural Product Notes) have more than doubled in volume in just three years, while other assets, many of them backed by CPRs, have also seen significant growth in this short period.

Some producers needed credit to invest in a highly profitable sector, and investors were willing to offer that credit in exchange for a fair return. However, excessive government interference, legal uncertainty, and a lack of transparency hindered the development of this market.

Development only occurred after legislative changes created a business environment encouraging private sector participation. Notably, this happened without creating any new financial products, except Fiagro. In other words, the products already existed but had not yet sparked interest among market participants. This expansion has contributed to the observed production growth in recent years following the study's results.

Finally, despite recent developments, the private rural credit market is still far from reaching its potential. Agribusiness accounts for about a quarter of Brazil's GDP, around R$2.6 trillion. There is still a significant demand for resources at all stages of production, as well as for investments, for example, in storage and pasture recovery. This will allow for the expansion of the agricultural frontier without the need to use native forest areas, contributing to the sustainable development of the industry and the country.

In the short term, we can foresee a scenario in which funds that pool resources from various investors to invest in agribusiness-related assets, whether in rural properties or sector activities, will take center stage due to their ability to attract national and international investors who are not profoundly familiar with the workings of Brazilian agribusiness. Additionally, fintechs can help reduce the information asymmetries that still exist, making this market increasingly democratic for both rural producers and investors.