Posted on July 9, 2024

Share:

The Brazilian fiscal policy in 2023, despite the stringent goals and constraints imposed by legislation, demonstrated remarkable resilience. Key eleme

a-concerning-scenario-analyzing-brazil-s-2023-fiscal-outcomes-and-future-risks

A Concerning Scenario: Analyzing Brazil’s 2023 Fiscal Outcomes and Future Risks

The Brazilian fiscal policy in 2023, despite the stringent goals and constraints imposed by legislation, demonstrated remarkable resilience. Key elements of the fiscal framework, including the Fiscal Responsibility Law and the recently implemented Sustainable Fiscal Regime (Regime Fiscal Sustentável, RFS), stood as pillars of stability. These rules were designed to maintain fiscal discipline, promote sustainable public finances, and ensure compliance with budgetary targets, instilling a sense of confidence in the system.

The Fiscal Responsibility Law (Lei de Responsabilidade Fiscal, LRF), enacted in 2000, was an important moment in Brazil’s fiscal management. It established guidelines for responsible fiscal management, imposed limits on public debt, required transparent budget planning, and mandated fiscal targets for primary balances and debt levels. The LRF aimed to enhance fiscal accountability and reduce fiscal risks by promoting sound budgetary practices among federal, state, and municipal governments, a significant step towards fiscal discipline.

In 2023, the new Sustainable Fiscal Regime (RFS), enacted through Complementary Law 200/2023, introduced additional fiscal rules to ensure long-term fiscal sustainability. The RFS sets primary balance targets, expenditure limits, and mechanisms to correct deviations from fiscal goals. These measures aimed to stabilize public debt and create a fiscal environment conducive to economic growth and stability. However, the government’s primary balance target was not easy to achieve. It was complicated by a combination of rising mandatory expenditures and revenue shortfalls, a challenge that required careful management.

In pursuit of the goals established by the RFS for 2023, it is possible to state that the Government revenues were not stable but experienced significant fluctuations due to various economic factors. Despite efforts to enhance tax collection and administration, revenue growth was constrained by slower economic recovery and lower-than-expected tax receipts from certain sectors, which are key sources of tax collection. Revenues administered by the Federal Revenue Service (Receita Federal do Brasil, RFB) increased, notably from taxes on gross revenue/consumption, which rose by BRL 42.7 billion (27.0%). However, the overall performance of these revenues was not enough to offset the fiscal pressures, as total primary revenues grew by 8.7% year-over-year, which did not adequately balance the significant rise in expenditures, highlighting the pressing need to address this issue.

On the expenditure side, primary spending saw a notable increase, primarily driven by social security benefits, judicial sentences, and other mandatory outlays. In 2023, primary expenditures increased by 12.6% compared to the previous year, amounting to BRL 78 billion. A significant factor was the early payment of “precatórios” (court-ordered debts), which accounted for a real increase of BRL 29 billion. Additionally, the disbursement of social security benefits, including the advance payment of the first installment of the 13th-month salary for retirees, contributed an additional BRL 8.1 billion. This substantial rise in mandatory expenditures presented a significant challenge to maintaining fiscal balance within the established legal limits, as the government struggled to accommodate these costs while adhering to the expenditure ceiling and other fiscal rules.

Considering all these numbers together, the fiscal results for the central government in 2023 reflected a decline in the primary surplus compared to previous years. The accumulated 12-month primary deficit as of April 2023 was substantial, amounting to BRL 251.9 billion, or 2.21% of GDP. This represents a significant deterioration from the previous year, when a primary surplus of BRL 14.5 billion, or 0.14% of GDP, was recorded, highlighting the increasing challenges in maintaining fiscal discipline.

These numbers had significant implications for Brazil’s public debt. The notable decrease in the primary surplus, coupled with the substantial primary deficit, led to a deterioration in the fiscal balance, thereby increasing the debt burden. This widening deficit contributed to the growth of the gross debt of the general government (DBGG). By the end of 2023, the DBGG reached 75.7% of GDP, up from 72.9% at the end of 2022. This increase in debt levels accentuates the government’s fiscal pressures, as rising interest payments on the growing debt stock further constrained the fiscal space for public investments and essential services.

The fiscal projections for 2024 and subsequent years suggest a challenging path to fiscal consolidation. Official estimates for 2024, as outlined in the March 2024 Report on Revenue and Primary Expenditure Assessment, project a primary deficit of BRL 9.3 billion for the central government. Although this deficit falls within the tolerance range set by the Budgetary Guidelines Law (so-called LDO in Portuguese), it signals ongoing fiscal strain.

Market projections like those from the Central Bank of Brazil’s Focus survey indicate a less favorable scenario. The median projection for the central government’s primary deficit in 2024 is around 0.64% of GDP, approximately BRL 73.9 billion. The Prisma Fiscal from the Secretariat of Economic Policy (SPE) forecasts a similar deficit magnitude, estimated at BRL 78.6 billion. These figures suggest that achieving the primary balance target set for 2024 will be challenging for the government.

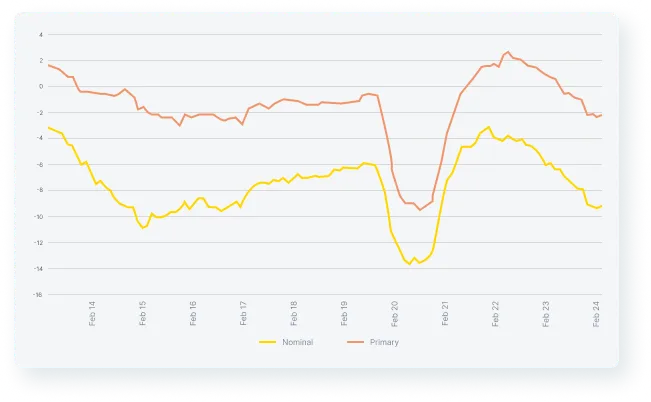

Government balance

For the years beyond 2024, the Project of Budgetary Guidelines (PLDO) for 2025 establishes gradual fiscal improvement targets. The primary balance targets for the central government are set at 0% of GDP for 2025, 0.25% for 2026, 0.5% for 2027, and 1.0% for 2028, each with a tolerance margin of 0.25% of GDP. These targets reflect a more optimistic outlook than market projections, anticipating continued deficits, albeit decreasing over time.

According to the Central Bank’s Focus survey, the DBGG/GDP ratio is expected to increase from 75.7% in 2023 to approximately 77.5% by the end of 2024, 79.9% in 2025, and 82.1% in 2026. In contrast, official projections from the PLDO 2025 foresee a more moderate rise, with the debt-to-GDP ratio reaching 76.6% by the end of 2024, 77.9% in 2025, and peaking at 79.7% in 2027 before gradually declining to around 74.5% by 2034.

In sum, the fiscal outlook for Brazil remains highly concerning. Achieving the established fiscal targets appears increasingly unlikely due to the government’s limited willingness to cut expenditures and the significant challenges in securing congressional approval for tax increases. Given these recent trends and projections, Brazil’s fiscal scenario is precarious. The consistent failure to meet fiscal targets, the government’s reluctance to implement necessary expenditure cuts, and the political difficulties in raising taxes are likely to perpetuate fiscal imbalances. This instability is expected to exert upward pressure on inflation expectations and interest rates, further complicating the broader economic outlook.

Authored by Cristiano Oliveira, Head of Research at Rivool Finance.

Tags

Private credit