Posted on June 14, 2024

Share:

In recent years, the adoption of blockchain technology has been a recurring theme across various industries, and agribusiness is no exception.

blockchain-technology-and-transparency-in-agribusiness-impact-on-the-credit-market

Blockchain Technology and Transparency in Agribusiness: Impact on the Credit Market

In recent years, the adoption of blockchain technology has been a recurring theme across various industries, and agribusiness is no exception. According to IBGE estimates, this emerging technology has transformed transactions, offering greater transparency and efficiency. These are crucial aspects for an agricultural sector contributing $365.8 billion to Brazil’s GDP in 2023 alone.

In agribusiness, tokenization can transform financing by allowing the issuance of tokens backed by credit demands structured by securitization companies. These tokens can be purchased by investors, providing capital to farmers and offering investors new accessibility to assets with potentially attractive returns. For example, Agribusiness Receivables Certificates (CRAs), which have a stock of R$ 138 billion, and Rural Product Notes (CPRs) with a stock of R$ 313 billion, according to B3, are already widely used in Brazil, and tokenization can take these instruments to a new level of reach and transparency.

Blockchain is a distributed ledger technology that provides a secure and transparent transaction ledger. Each transaction is recorded in a block and linked to previous blocks, creating an unbreakable data chain. This provides a transparent and immutable view of all activities conducted, eliminating the need for intermediaries and significantly reducing transaction costs. Technologically, it operates through a network of computers, known as nodes, that work together to validate and record transactions. When a new transaction is initiated, it is sent to the network, where the nodes verify its validity using cryptographic algorithms. After validation, the transaction is grouped with others into a block.

Each block contains a cryptographic hash of the previous block, a timestamp, and the transaction data. This hash is a unique sequence generated from the block’s data, ensuring that any alteration in the data would change the subsequent hash. This creates a chain of blocks (hence the name blockchain) that is linear and chronological, preventing previous transactions from being altered or deleted without immediate detection.

One of the most promising concepts associated with blockchain is asset tokenization. This practice involves creating digital tokens representing real assets, such as agricultural commodities, land, or future production contracts. Tokenization facilitates trading these assets on digital platforms, increasing liquidity and accessibility.

For investors, blockchain and tokenization offer a way to diversify portfolios and invest in this sector, which is vital to the global economy. Agriculture represents about 28.5% of Brazil’s GDP, and with the growing global demand for food and accessible investment options in this sector, the return prospects are promising. Additionally, tokenization can provide liquidity in secondary markets, depending on the asset, something traditionally challenging to achieve with agricultural assets.

Tokenization can facilitate access to financing for producers, exceptionally tiny and medium farmers. Many producers face difficulties obtaining credit due to a lack of transparency and high transaction costs. Blockchain can reduce these barriers, allowing more farmers to access the necessary resources to expand their operations and increase productivity.

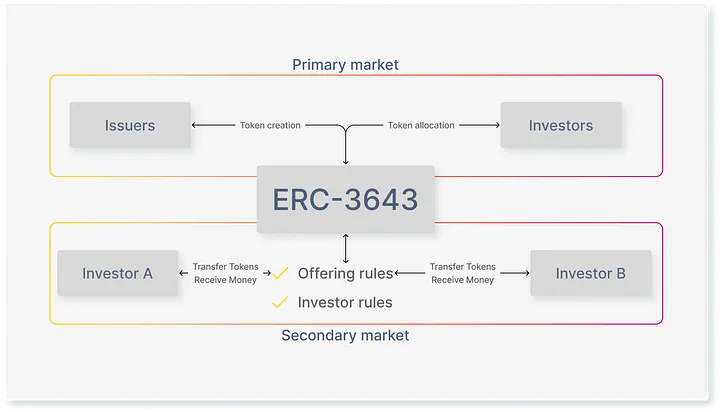

Recently, the Ethereum community adopted the ERC-3643 standard as a reference for tokenizing real assets. This standard establishes clear guidelines for creating and managing tokens that comply with international regulations. This standard ensures that tokens represent the value of the underlying assets and incorporate layers of compliance and security, such as identity verification and transfer restrictions.

This protocol implements automatic compliance rules through smart contracts, ensuring applicable local and international regulations carry out transactions and token transfers. These rules include Identity Verification (On-chain ID), where each transaction undergoes an identity verification, ensuring that only authorized individuals or entities can participate; Regulatory Compliance, in which smart contracts incorporate rules that automatically verify compliance with specific regulations, such as KYC (Know Your Customer) and AML (Anti-Money Laundering), allowing transactions to be blocked or rejected if they do not meet the established criteria; and Transfer Restrictions, which would enable tokens issued through ERC-3643 to be programmed to include geographic limits or approval requirements, ensuring that assets are not transferred to unauthorized parties.

For example, a protocol like ERC-3643, used to tokenize approximately $28 billion in assets, can be applied to transform how producers access financing. This standard, adopted globally in over 180 jurisdictions, offers more than 120 distinct functions and manages over 40 types of different tokens, making it a robust tool for asset tokenization in the agricultural sector. With the traceability and transparency provided by blockchain, the risks associated with agricultural financing decrease, making credit more accessible and providing better conditions for producers.

Although the benefits of blockchain are clear, adopting this technology in agribusiness still faces challenges. The technological infrastructure in rural areas needs improvement, and identifying risks in returns and regulatory bureaucracies are examples of difficulties so far. Additionally, continuous efforts are required to ensure blockchain platforms are secure and resistant to fraud.

In summary, the future outlook is optimistic. Blockchain can facilitate access to credit by helping to build a public score, which would increase producers’ transparency and reliability in the eyes of creditors. This public score would allow a more accurate assessment of farmers’ credit history and financial capacity, enhancing creditor confidence and reducing perceived risk. Additionally, tokenization facilitates the provision of guarantees by offering tokenized assets as collateral. These tokenized assets, such as future crops or land, can be easily audited and monitored through blockchain, providing additional security for those offering credit.

With more robust and transparent guarantees, creditors have an extra layer of protection, which can result in better financing conditions and lower interest rates for producers. A notable example is the Depository Trust & Clearing Corporation (DTCC) in the United States. This international project uses distributed ledger technology (DLT) to evaluate the commercial feasibility of reducing collateral needs, resulting in a 15% to 20% reduction in the volume of guarantees. This was achieved by eliminating counterparty risk through the Delivery versus Payment system and reducing the need for transaction reconciliation, demonstrating how tokenization can significantly increase efficiency and reduce costs.

Authored by

Tiago Piassum Theodoro, founder of Rivool Finance.

Tags

Private credit