Posted on July 23, 2024

Share:

Brazil’s economic landscape in 2023 was a complex interplay of factors that led to disinflation. These factors included the normalization of global

brazil-s-inflation-in-2023-analysis-and-2024-outlook

Brazil’s Inflation in 2023: Analysis and 2024 Outlook

Brazil’s economic landscape in 2023 was a complex interplay of factors that led to disinflation. These factors included the normalization of global supply chains, the waning initial effects of the war in Ukraine, and favorable weather conditions during the winter in the Northern Hemisphere. Additionally, the Federal Reserve’s contractionary monetary policy led to a decline in the prices of risk assets and, consequently, in commodity prices.

The appreciation of the Brazilian currency, the Real, against the Dollar, alongside falling international commodity prices, further amplified the deflationary impact of this crucial cost component. Typically, a decline in global commodity prices coincides with a depreciation of the Real. Historically, there has been a negative correlation between the movement of commodity prices in dollars and the real/dollar exchange rate. However, the pandemic disrupted this correlation, with rising dollar prices and devaluation occurring simultaneously, contributing significantly to the Brazilian economy’s inflationary surge in recent years. This unique situation, which was a direct result of the global health crisis has now started to revert.

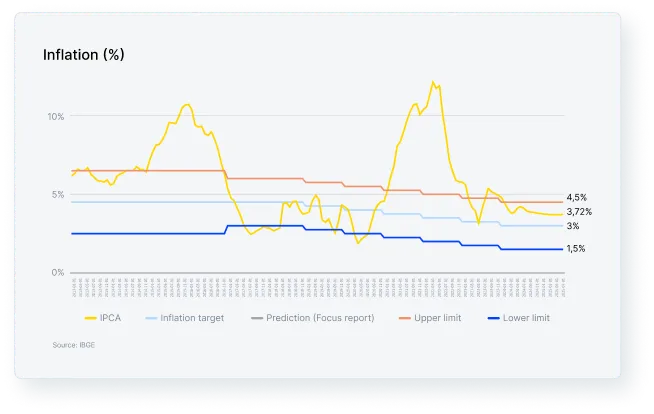

As a result, the decrease in international commodity prices, particularly food prices, combined with the exchange rate appreciation and high interest rates imposed by Brazil’s monetary authority, exerted strong deflationary pressure. This was initially observed in wholesale and producer prices. In 2023, the Brazilian inflation rate, as measured by the IPCA (the Brazilian Consumer Price Index used for inflation targeting), stood at 4.62%, which is 1.16 percentage points lower than the rate recorded in the same period of the previous year.

In 2023, Brazil’s inflation rate stood out in comparison to several key economies. While it was lower than Colombia’s 9.3%, it was higher than other major economies and regions. For instance, the United States, Peru, and the European Union had an inflation rate of 3.2%, while Mexico’s rate was slightly lower at 4.4%. Chile experienced an inflation rate of 3.9%, and China saw deflation at -0.3%. These variations in inflation rates underscore the unique economic challenges faced by each country. Colombia’s high inflation was driven by political instability, supply chain disruptions, and significant depreciation of the Colombian peso, which increased the cost of imports. In contrast, Brazil’s inflation, although higher than that of the United States and the European Union, reflects the lingering effects of previous economic policies, fluctuations in commodity prices, and structural economic issues.

Inflation rate in 2023

The United States and European Union maintained inflation relatively lower due to robust monetary policies and better-controlled supply chains post-pandemic. The Federal Reserve and the European Central Bank effectively implemented measures to curb inflation, including interest rate adjustments. Peru and Chile also benefited from relatively stable economic policies and external trade conditions. At the same time, China’s deflation was primarily due to its strict COVID-19 policies, which suppressed domestic demand, and its economic structure, which relies heavily on exports, faced global demand fluctuations. This comparison emphasizes Brazil’s distinct challenges in maintaining inflation near its target rate. Despite some progress in recent years, considerable work remains to ensure long-term price stability.

In 2024, the international geopolitical landscape remains volatile, with potential conflicts posing significant risks to global economic stability. These increased tensions could lead to higher commodity prices, especially in energy markets, which could, in turn, exacerbate Brazil’s production costs and consumer prices. Such a scenario could counteract the disinflationary trends observed in 2023 and early 2024, potentially increasing financial market volatility and complicating Brazil’s economic outlook.

Despite the global challenges, the Brazilian economy is poised for moderate growth in 2024. This growth, driven by domestic and external factors, is expected to create new employment opportunities and thereby reduce unemployment. It may lead to upward pressure on wages, particularly in labor-intensive sectors like personal services, potentially offsetting some disinflationary effects.

El Niño is expected to significantly impact agricultural production in 2024, with adverse weather conditions likely to disrupt crop yields and increase food prices. This is concerning, given the acceleration in food prices in early 2024. The market anticipates these climatic impacts exerting inflationary pressures, challenging the Central Bank’s ability to maintain inflation within the target range. Effective policy responses and contingency planning will be crucial in mitigating El Niño’s adverse effects on inflation.

Considering all these factors, market expectations for inflation in 2024, as reflected in the Central Bank of Brazil’s Focus Report, project an IPCA (Extended Consumer Price Index) rate of 3.8%, lower than the 4.62% rate recorded in 2023. The Central Bank’s Monetary Policy Committee (Copom) has an even more optimistic outlook, with a projection of 3.5%. These forecasts incorporate various factors, including anticipated moderation in service price increases and a more stable trajectory for administered prices. This certainly reflects the market’s confidence in the Brazilian independent Central Bank’s ability to steer the economy towards its inflation targets and not the government to achieve fiscal balance.

Early data from the first quarter of 2024 indicate that inflation trends align closely with market expectations. Despite some upward surprises in food prices, other sectors, such as services and industrial goods, have shown moderated price increases. The observed 12-month accumulated inflation rate has continued its downward trend, reinforcing confidence in achieving the projected targets for the year.

The Central Bank of Brazil has a pivotal role in this context. Effective monetary policy is crucial to managing inflation expectations and controlling price levels. The Central Bank’s decisions on interest rates, money supply, and other monetary tools are essential to keep inflation within the desired range. In 2023, the Central Bank’s efforts contributed to a gradual disinflation process, but the goal of aligning inflation with the target rate necessitates sustained vigilance and strategic policy implementation. Achieving and maintaining a stable inflation rate close to the target requires a balanced approach, incorporating both short-term and long-term strategies. As Brazil navigates the economic landscape of 2024, the focus must remain on maintaining and enhancing the gains made in controlling inflation, ensuring economic growth, and fostering a stable financial environment.

Authored by Cristiano Oliveira, Head of Research at Rivool Finance.

Tags

Private credit