Posted on July 3, 2024

Share:

Agribusiness, a key player in Brazil’s GDP and export activities, has consistently defied economic recessions, showcasing remarkable resilience and

brazilian-agribusiness-a-sector-immune-to-crises

Brazilian agribusiness: a sector immune to crises

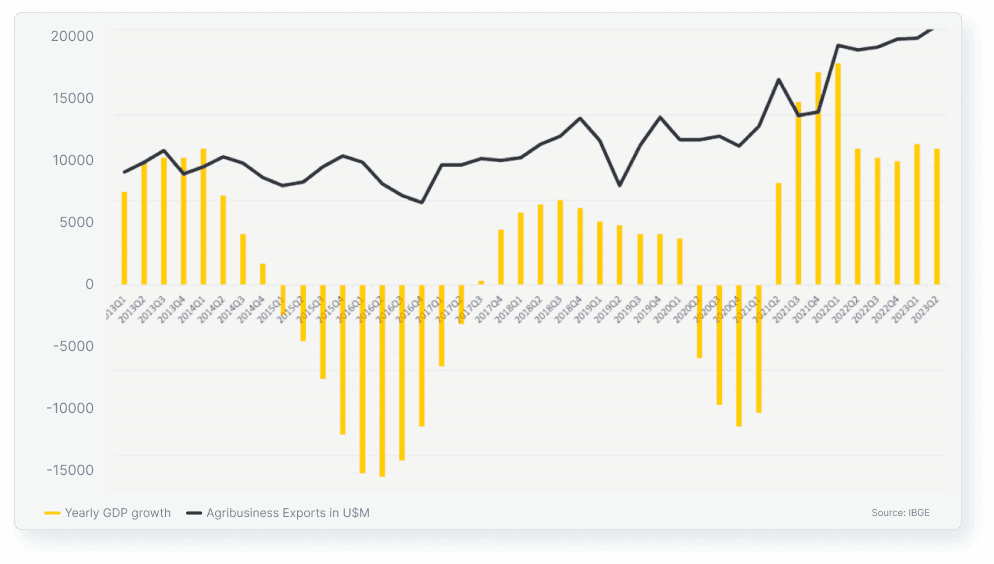

Agribusiness, a key player in Brazil’s GDP and export activities, has consistently defied economic recessions, showcasing remarkable resilience and growth. Its stability and export expansion has acted as a shield against domestic economic downturns, emphasizing its strategic significance to the national economy. Notably, Brazilian agricultural exports have not just weathered crises but flourished, a testament to the sector’s reliability and global competitiveness.

In 2023, exports, particularly agricultural exports, were the driving force behind Brazilian economic growth. Over the past decade, the Brazilian agricultural sector has survived and thrived, demonstrating exceptional stability and development. Even in the face of one of the most severe recessions in its history between 2015 and 2017, the sector stood tall. This recession, resulting from economic policy errors and declining international commodity prices, was a true test of the sector’s resilience. The ‘New Economic Matrix,’ a set of measures including interest rate reductions, devaluation of the real against the dollar, tax exemptions for industries, credit expansion through public banks, and reduced energy tariffs, contributed to the crisis. Despite these challenges, the sector’s exports remained robust, a clear sign of its ability to overcome adversities.

The period leading up to the recession was also marked by corruption scandals and intense political instability, culminating in the impeachment of President Dilma Rousseff. Despite this internal turmoil and the external challenges posed by falling commodity prices, the quantum of exports increased, maintaining the value of exports. Post-crisis, there was a significant rise of approximately 20% in the average value of exports, a trend that persisted through the pandemic’s most critical period. By 2021, the value of exports had nearly doubled compared to the pre-pandemic period. This increase was driven not only by higher international commodity prices but also by greater diversification of exported products and an increased quantum of exports of traditional products. These gains were facilitated by climatic problems in competing countries, pandemic-related closures, and the war in Ukraine, which boosted Brazil’s standing as a leading and reliable global food producer.

The unique characteristics of Brazilian agribusiness, particularly its export-oriented segments, distinguish it from other sectors of the Brazilian economy. While other sectors often struggle during domestic economic crises, Brazilian agribusiness has consistently demonstrated resilience. This resilience has been evident throughout the past decade, during the 2015–2017 recession and the pandemic. Therefore, investing in Brazilian agribusiness can serve as a hedge against economic instability, given its historical role as a countercyclical counterweight in adverse economic scenarios.

This analysis not only underscores the strategic importance of the agribusiness sector to the Brazilian economy but also highlights its promising future. As the global demand for food continues to grow and diversify, Brazilian agribusiness is well-positioned and poised to capitalize on these trends. This potential for future growth is a beacon of hope in times of financial uncertainty, inspiring confidence in the sector’s ability to steer the economy forward.

Authored by Cristiano Oliveira, Head of Research at Rivool Finance.

Tags

Private credit