Posted on July 12, 2024

Share:

Brazil’s economic performance in 2023 demonstrated notable resilience and a capacity for growth amidst various global and domestic challenges. Brazil

brazilian-gdp-grew-above-expectations-in-2023-driven-by-exports

Brazilian GDP grew above expectations in 2023, driven by exports

Brazil’s economic performance in 2023 demonstrated notable resilience and a capacity for growth amidst various global and domestic challenges. Brazil’s Gross Domestic Product (GDP) expanded by 2.9% over the year, reflecting a combination of factors contributing to this growth trajectory.

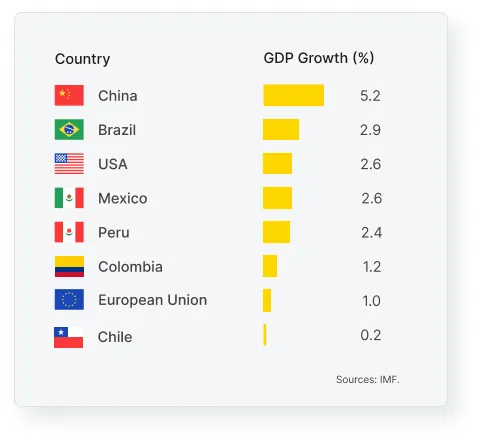

This growth showcased Brazil’s resilience and emerged as a standout performance compared to its Latin American counterparts. Achieving a 2.9% increase in GDP, Brazil was among the countries with the highest growth rates in the region. Given the global economic challenges, this growth was particularly impressive, positioning Brazil prominently on the international stage. This accomplishment highlights Brazil’s potential to navigate economic uncertainties and capitalize on growth opportunities, particularly through increases in the demand and prices of commodities.

The table presented highlights the GDP growth rates for various countries in 2023, offering a comparative view of economic performance across different regions. Brazil achieved a GDP growth rate of 2.9%, outperforming several key economies, including the United States (2.6%), the European Union (1.0%), and Mexico (2.6%). Among its Latin American peers, Brazil’s growth rate was significantly higher than that of Colombia (1.2%), Chile (0.2%), and Peru (2.4%), indicating a relatively strong economic performance in the region. Notably, China led the group with a growth rate of 5.2% in 2023. Although this rate is lower than their historical average of 10% since 1978, it signals a significant recovery following the pandemic. This growth underscores China’s resilience and capacity to rebound despite the challenges posed by the global health crisis.

Economic Growth in 2023

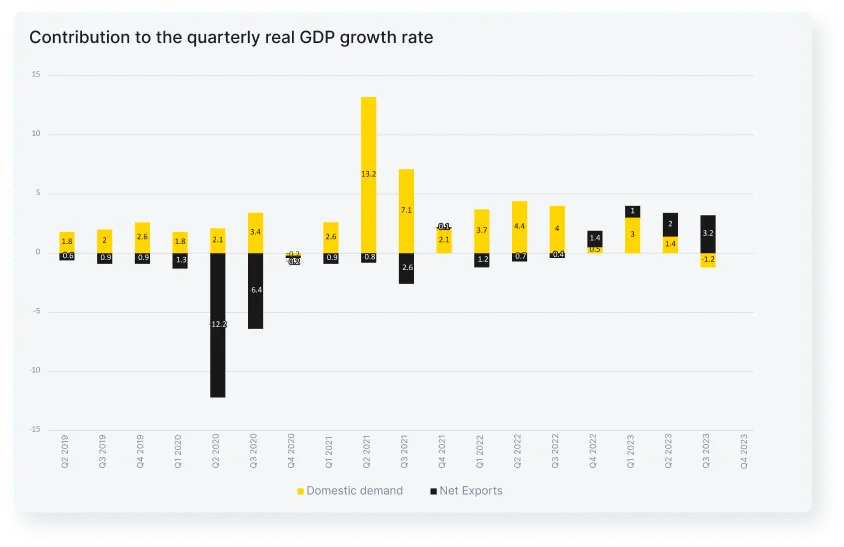

In 2023, Brazil’s GDP growth was driven primarily by the agricultural, industrial, and services sectors. The agricultural sector saw a remarkable 15.1% growth, contributing 0.9 percentage points (p.p.) to the GDP, despite a 5.3% decline in the fourth quarter. The industrial sector increased by 1.6%, contributing 0.4 p.p., with notable performances in extractive industries (8.7%) and utilities (6.5%). The services sector, growing by 2.4%, was the largest contributor, adding 1.4 p.p. to the annual GDP growth.

From the expenditure perspective, household consumption grew by 3.1% in 2023, contributing 2.0 p.p. to GDP growth, driven by improvements in the labor market and income support policies. However, investments, measured by Gross Fixed Capital Formation (GFCF), fell by 3.0%, subtracting 0.5 p.p. from annual growth. Exports were a key highlight, increasing by 9.1%, significantly boosting economic growth. In contrast, imports decreased by 1.2%, with net exports adding 2.0 p.p. to the GDP growth. This underscores the critical role of exports in supporting Brazil’s economy in 2023.

In 2023, Brazil’s export sectors demonstrated significant growth, contributing notably to the country’s economic expansion. The key sectors driving this growth were agribusiness, extractive industries, and the service sector. Agribusiness alone accounted for a substantial portion of Brazil’s total exports, marking a year of robust performance with a 4.9% increase from the previous year, leading to an export value of $165.05 billion.

The extractive industry also showed remarkable growth, benefiting from high commodity prices and strong global demand. This sector’s exports were crucial in reducing Brazil’s trade deficit and enhancing its GDP growth. While not as dominant in direct export value as agribusiness or extraction, the service sector supported the economic infrastructure necessary for the efficient export of goods and services, thereby indirectly contributing to the overall export growth.

Agribusiness was particularly relevant, with commodities like soybeans, beef, and sugar leading the way. Soybeans remained the top agricultural export in volume and revenue, significantly increasing due to favorable market conditions and high international demand. Sugar exports surged by 42.9% in value, propelled by a global reduction in supply and consequent price increases. These sectors underpin Brazil’s trade surplus and underscore the country’s role as a leading international supplier of critical agricultural and extractive products.

This robust export performance has bolstered Brazil’s GDP and employment. In 2023, Brazil witnessed significant improvements in its labor market, largely fueled by the economic growth observed throughout the year. The unemployment rate declined from 11.1% at the end of 2021 to 7.6% by 2023, indicating a robust recovery and better job creation across various sectors after the pandemic.

According to the New General Register of Employed and Unemployed (Novo Caged), 1.48 million new formal jobs were created in 2023. Sectorial analysis revealed substantial job generation in specific industries. The sectors that stood out in employment growth included the construction sector and domestic services, which also showed significant growth rates of 6.6% and 8.5%, respectively.

Looking ahead, growth expectations for Brazil’s GDP in 2024 are set at 1.9%, potentially ranging between 1.5% and 2.2%. This forecast has been revised upward since the start of the year, suggesting a cautiously optimistic outlook from economic analysts. Earlier in the year, expectations had dipped as low as 1.2%, reflecting concerns over potential economic hurdles. Fiscal outcomes are expected to influence interest rates and inflation expectations, potentially temper growth projections for 2024 and beyond.

Despite these concerns, the overall outlook suggests a strategic focus on stability and gradual growth, supported by improvements in economic indicators and policy adjustments to foster a stable economic environment. For subsequent years, projections stabilize around 2.0% annually, indicating expectations for sustained, moderate growth without significant fluctuations. This outlook suggests a strategic focus on stability and gradual growth rather than short-term surges that might lead to increased volatility.

Authored by Cristiano Oliveira, Head of Research at Rivool Finance.

Tags

Private credit