Posted on March 15, 2024

Share:

Tokenization represents a transformative force that promises to reshape markets and redefine traditional property rights systems. However, among the

breaking-ground-addressing-barriers-to-tokenization-adoption

Breaking Ground: Addressing Barriers to Tokenization Adoption

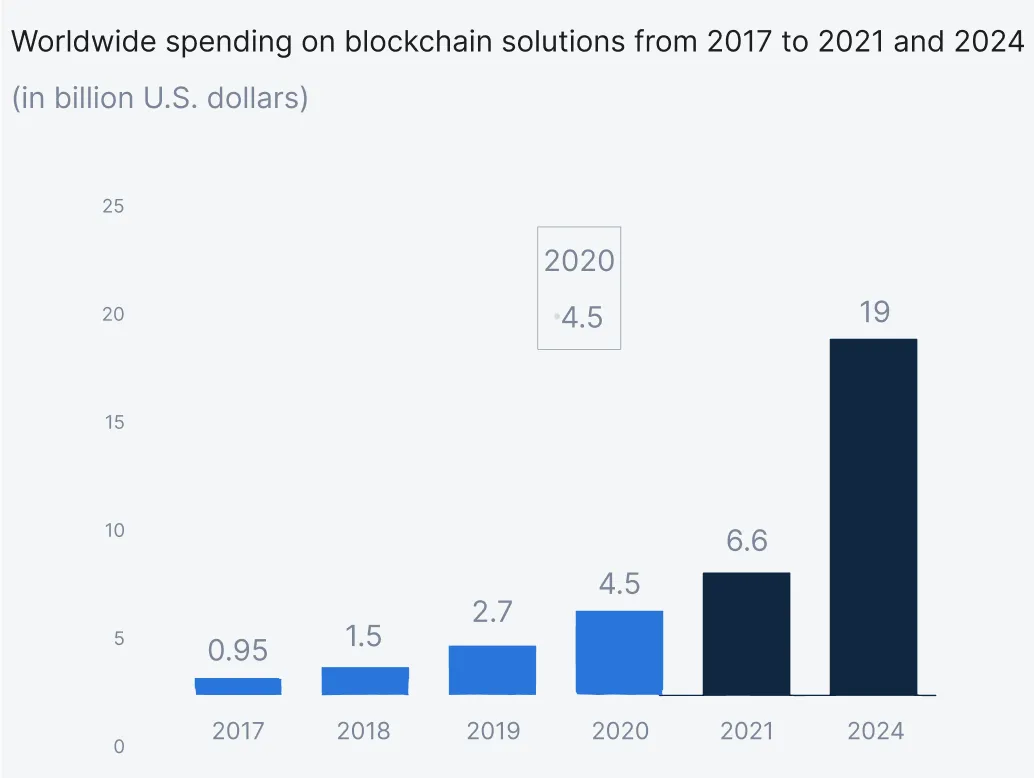

In the dynamic context of blockchain technology and its rapid evolution, tokenization represents a transformative force that promises to reshape markets and redefine traditional property rights systems. However, among the promises of efficiency and transparency, the path to widespread adoption of tokenization is not without obstacles. Many financial market participants predict that the tokenization opportunity amounts to tens of trillions of dollars. A recent PwC “Time for Trust” report on blockchain and the evolving market found the technology could improve global GDP by an average of USD 1.76 trillion by 2030. According to PwC economists, this is a total of 1.4% of the global GDP today. Although it is possible to observe some interesting use cases, these are a drop in the ocean compared to the volume of digitized assets that could circulate on-chain in the coming years.

The fact is that there are some barriers currently that slow its adoption and prevent the seamless integration of tokenization into various industries. Among these bottlenecks are the persistent scalability and interoperability issues that hinder the development of blockchain networks and the crucial need for widespread dissemination of knowledge about blockchain technology. Something predictable and probably inevitable in such a recent technology. Each of these barriers presents a unique challenge to address. However, as we delve deeper into the complexities of these difficulties, it is possible to discover the best strategies and solutions that can pave the way for the integration of tokenization to be successful in the markets.

One of the main barriers to the widespread adoption of tokenization lies in the scalability challenges. As the demand for decentralized applications and tokenized assets continues to grow, major blockchain platforms face limitations in processing speed and their ability to record transactions. For instance, well-known cryptocurrencies such as Bitcoin and Ethereum can record 7 and 20 transactions per second, respectively. In contrast, traditional payment methods, such as Paypal and Visa, can record 193 and 24000 transactions per second, respectively.

If, on the one hand, this restriction makes evident the limits of the use of cryptocurrencies as a means of payment, on the other hand, it makes it clear that blockchain networks will have to accelerate their development to be able to adopt in markets where many transactions occur. After all, one of the main advantages of tokenization is its ability to bring more liquidity to previously illiquid markets. Therefore, the barriers to the number of transactions must be overturned to achieve this greater liquidity.

One of the technologies available is the one provided by Polygon. The technology is a protocol and framework for building and connecting Ethereum-compatible blockchain networks. It is a protocol designed to solve scalability issues on the Ethereum blockchain, providing a solution for faster and more cost-effective transactions. Among the key points regarding Polygon technology, we can mention the existence of Layer 2 scaling for Ethereum. The protocol aims to increase scalability by creating a second layer on top of the Ethereum mainnet, where transactions can be processed faster and at lower costs. The protocol also uses sidechains to process transactions outside of the Ethereum mainnet. These parallel chains can run custom consensus mechanisms and operate independently while connected to the Ethereum network. In addition, the protocol supports several consensus mechanisms, including Proof-of-Stake (PoS), which is more energy-efficient than the Proof-of-Work (PoW) mechanism used by Ethereum. With all these actions together, the protocol contributes to a more sustainable and scalable ecosystem.

However, the limitations of speed and number of operations are not the only barriers limiting tokenization’s potential. There is also an interoperability issue. The blockchain landscape is characterized by a dichotomy between public and private infrastructures, each serving distinct purposes and audiences. As exemplified by Ethereum and Bitcoin, public blockchains operate on a decentralized, permissionless model, ensuring transparency and security through a distributed network of nodes. On the other hand, private blockchains, often used by businesses, prioritize privacy and restricted access among a defined set of participants.

Achieving interoperability between these blockchain domains is a critical challenge for seamless tokenization integration. Thus, interoperability solutions include the development of cross-chain protocols and standardized communication layers. These initiatives aim to establish a bridge between public and private blockchains, allowing tokens and data to flow seamlessly across different networks. Polygon is known for its interoperability, allowing seamless integration with the Ethereum blockchain. This compatibility enables, for example, developers to port their decentralized applications (DApps) and smart contracts from Ethereum to Polygon with relative ease.

It should be noted that interoperability is not just a technical challenge. It involves the creation of common standards and collaborative efforts within the blockchain community to ensure that public and private infrastructures can coexist harmoniously. The lack of standardized protocols and communication between various blockchain networks limits the smooth transfer of tokens between platforms. In this context, the inability of different blockchains to interact seamlessly restricts the overall potential of tokenization, fracturing the ecosystem and preventing its integration into broader financial and business networks, thus compromising its scalability. So, for example, tokenized real assets may face liquidity challenges, especially if the secondary market for these tokens is not sufficiently developed. Poor tradability can affect the ease of buying or selling assets and, in this way, impacting their value.

As such, there is a need for collaborative efforts within the blockchain community to develop scalable solutions that facilitate the efficient and seamless movement of tokens across multiple networks. While market competition is vital, an alternative is for this market to establish a leadership that can set a standard based on its efficiency differential concerning other options in the market. So, to get ahead in the industry, market participants must strive for consensus and the development of a common platform for minting, redeeming, and swapping, either through a superior application or a platform built on a zero-layer blockchain capable of interconnecting the other layers. The opposite path, the industry’s fragmentation, with each company having its infrastructure closed and authorized, certainly hinders convergence towards a unified and valuable blockchain ecosystem.

Alternatively, layer-2 (off-grid) networks, such as Polygon’s, are a promising solution to address challenges on the public infrastructure side. As custodians, for example, financial institutions focus on providing a standard operating model to customers, regardless of whether they invest in assets through public or permissioned blockchains. However, achieving interoperability between networks and addressing regulatory and privacy concerns remain significant challenges to fully harnessing blockchain’s potential for token issuance on decentralized public infrastructures.

On another front of difficulties, while tokenization holds the promise of democratizing access to assets and revolutionizing traditional financial models, there is the prevailing knowledge gap around blockchain technology. Understanding the nuances of blockchain technology, smart contracts, and tokenized assets remains challenging for the general public and even market participants who could benefit from tokenization. This lack of knowledge extends beyond individual investors to companies and policymakers, inhibiting the formulation of coherent strategies and regulations that can foster technology development rather than hinder it. The complexities of tokenization require knowledge about technology that often eludes the average citizen, creating a barrier to entry for widespread adoption. Bridging this knowledge gap is not only imperative to fostering trust, but it is also essential to unlocking the true potential of tokenization. Public education initiatives, industry collaborations, and transparent communication efforts are crucial components of overcoming this information hurdle, ensuring that the gains from tokenization are embraced by a well-informed community willing to embrace this new financial standard.

Despite all these barriers, it has been possible to see incredible progress in overcoming these problems in the past year. According to Colin Butler, Global Head of Institutional Capital at Polygon, while it’s easy to show the projects that didn’t come to fruition, the real story of tokenization in 2023 is about the groundwork that will enable the next wave of tangible on-chain results driven by the power of key financial players entering the market. The outlook for everyone participating in the tokenization ecosystem is that 2024 will be filled with immense advancements. First, it is already possible to observe an intense interest from equity funds looking to develop new tokenization vehicles for their investors, and even more so by rushing these ideas into practice. Second, we can project that this trend will continue in 2024 as major institutions, including Hamilton Lane and JP Morgan, increasingly develop tokenized funds. Inevitably, we will soon see the development of even more structured instruments, including assets built from new sources of revenue, such as private credit — the next logical step for financial products that are inherently digital and relatively easy to migrate to the blockchain.

Authored by

Cristiano Oliveira

Associate Professor at the Federal University of Rio Grande — FURG andHead of Research at Rivool Finance

Tiago Piassum Theodoro

Founder of Rivool Finance

Tags

Private credit