Posted on October 18, 2023

Share:

One of the most significant challenges in the private risk analysis industry is establishing and maintaining credibility, especially following notable

challenging-credibility-the-future-of-risk-analysis-in-latin-america

Challenging Credibility: The Future of Risk Analysis in Latin America

One of the most significant challenges in the private risk analysis industry is establishing and maintaining credibility, especially following notable failures during major global crises.

For example, during the 2008 financial crisis, rating agencies failed to adequately warn investors about the real risks associated with mortgage-backed securities issued by US banks. Examples abound:

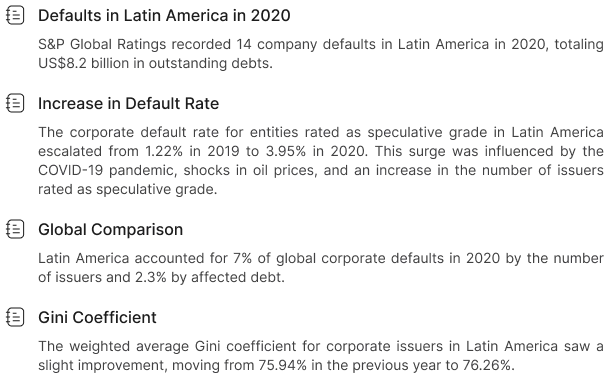

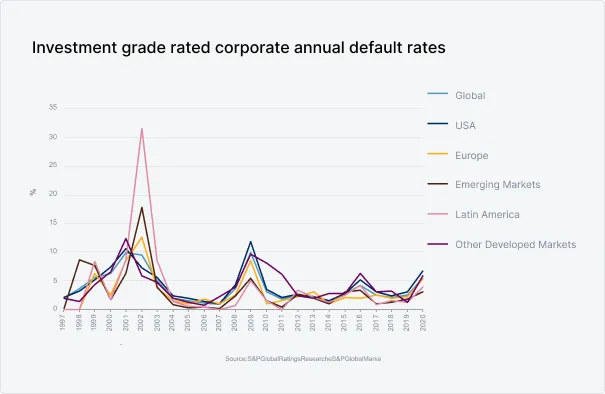

Allegations of bias within these agencies raised doubts about the industry’s integrity. Additionally, the inherent conflict of interest in the business model raises questions about the source of funding for rating agency evaluations. For exemple, a recent work done by S&P Global brought us the following understandings:

The credibility deficit of rating agencies creates hesitancy among investors to allocate capital to Latin America.

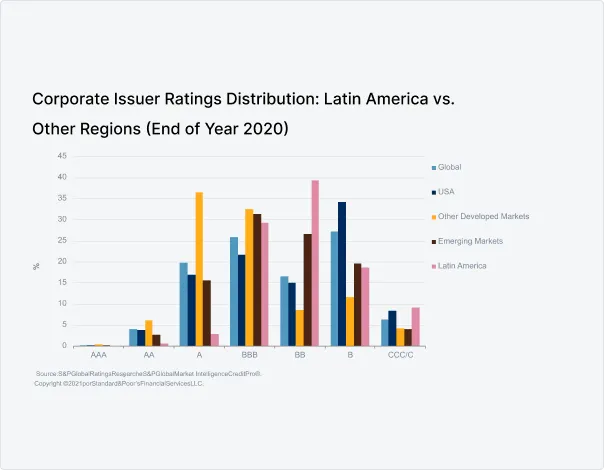

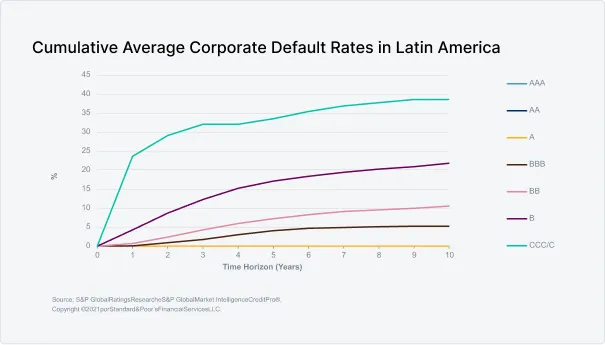

However, the S&P Global study only scratches the surface. The accompanying graphs reveal intriguing nuances, notably the concentration of Latin American companies in the BB category, despite a recent history of low defaults in this category.

Rating agencies consistently assign a BB credit risk classification to Latin America. Yet, international investors remain cautious, primarily due to concerns over the credibility of these risk assessments. This apprehension shouldn’t lead investors to dismiss the continent entirely. The following three graphs present relevant information about it:

Transforming Rating Services

We believe that rating services need to undergo significant transformations to realign the interests of rating agencies with those of investors. The existing BB credit risk classification assigned to Latin America by rating agencies does not instill confidence in international investors, despite a notably lower default rate in the region. However, we don’t believe investors should disregard this continent entirely. We will demonstrate how our solutions empower investors to safely explore the abundant opportunities available.

Solving the Risk Analysis Problem

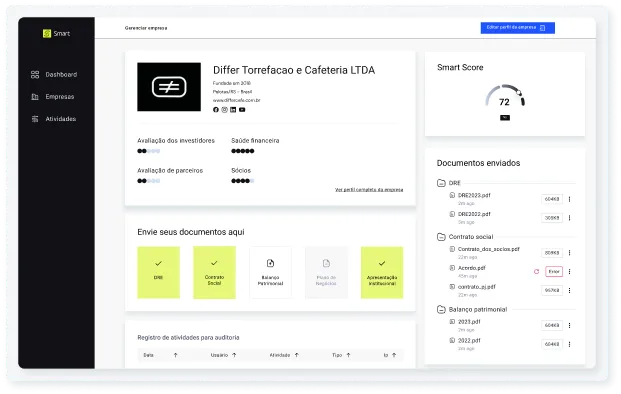

Our solution to the risk analysis problem is the Smart Score — a methodology designed to resolve the conflict of interest commonly found in traditional rating agencies and address the information gap between issuers and investors. The Smart Score utilizes a combination of due diligence metrics, financial analysis, and continuous risk monitoring to evaluate companies.

By carefully analyzing the documents received and ensuring issuer accountability for the information provided, our evaluations are conducted systematically, eliminating conflicts of interest.

This systematic approach not only streamlines evaluations but also enhances transparency across the digital asset credit ecosystem, ensuring investors have access to reliable and impartial information.

Prudent Risk Classification

Efficiency and risk management are at the heart of Rivool’s credit approval process. Our commitment to stringent financial standards and a well-defined risk classification empowers us to offer our clients a competitive advantage and a secure environment for their investment decisions.

We’re excited to share that we’ll be publishing a detailed article on the Smart Score methodology later this week. In this comprehensive piece, we’ll provide an in-depth exploration of how the Smart Score works and how it can significantly benefit your investment decisions.

Authored by:

Tiago Piassum Theodoro

Founder of Rivool Finance

Tags

Private credit