Posted on April 10, 2024

Share:

These credit certificates, issued by securitization companies and backed by agricultural receivables, act as an effective mechanism to direct resour

cras-and-the-potential-for-growth

CRAs and the potential for growth

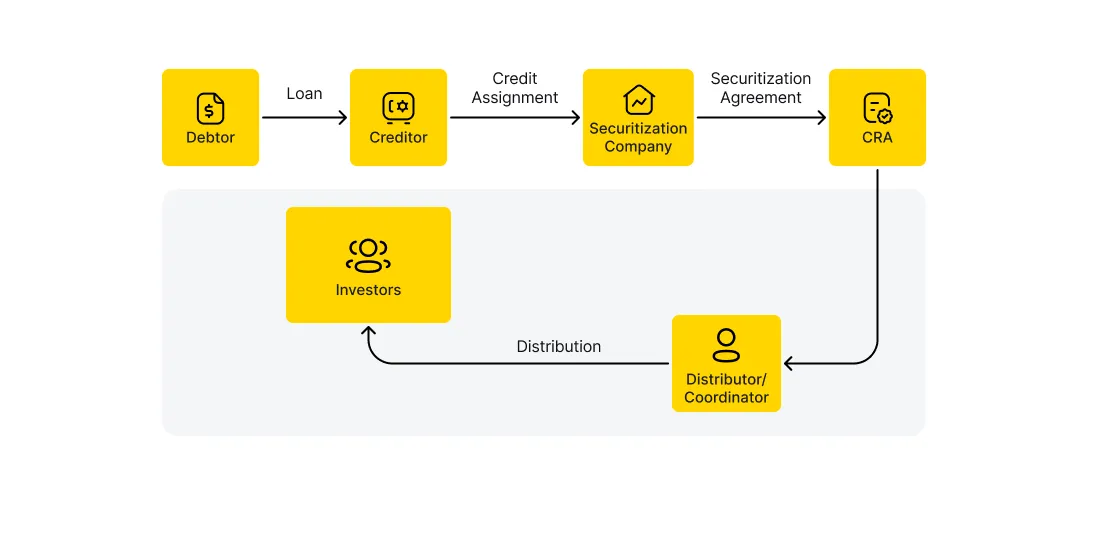

Agricultural Receivables Certificates (CRAs) have stood out in the Brazilian financial market since the announcement of Law №11.076/2004, not only for their growth potential but also for the opportunities they offer both to rural producers and investors. According to its Article 36, “The Agricultural Receivables Certificate — CRA is a nominative credit certificate, freely negotiable, representative of a promise of payment in money, and constitutes an extrajudicial enforceable title.” These credit certificates, issued by securitization companies and backed by agricultural receivables, act as an effective mechanism to direct resources straight to the agricultural sector, benefiting from the commercial operations conducted within this form of production. Below is a demonstration of their operational flow:

The process begins in the agricultural sector, where a rural producer (debtor) obtains financing or sells their products on credit to a company or financial entity (creditor), thus generating a future receivable right, known as a “receivable.” Then, a company specialized in purchasing these rights, the securitization company, acquires this receivable from the original creditor. The securitization company then structures the operation to turn this receivable into a negotiable title, namely, the CRA. After the structuring, the role of distributor or offer coordinator is taken on by a financial entity, which is responsible for placing these CRAs on the market, initially subscribing to them. Finally, these CRAs are made available in the market for investors, who purchase them in search of future returns based on the receivables that originated the title.

The importance of CRAs in financing Brazilian agribusiness is extensive. Firstly, they meet the growing demand for financing in a sector that is crucial to the country’s economy, driving production, commercialization, industrialization, and the provision of services related to agribusiness. This is essential in a context where Brazil continues to establish itself as a global agricultural powerhouse, requiring continuous investment in technology and infrastructure to sustain and expand its agricultural activities.

Moreover, CRAs represent an attractive alternative to traditional financing, offering potentially more favorable conditions in terms of rates and terms. For investors, they promise portfolio diversification with the added advantage of income tax exemption for individuals, a tax incentive that significantly increases the attractiveness of these titles. This feature is particularly relevant in a context of searching for investment options that combine profitability and tax benefits, despite not having the guarantee of the FGC (Credit Guarantee Fund).

Regarding security, the securities are backed by agribusiness receivables, offering a guarantee that mitigates risks for investors. This foundation is complemented by the flexibility in structuring CRAs, allowing them to adapt to the specific needs of issuers and investors, including variations in payment terms and return rates.

In the CRA market, we find two distinct configurations: the single-risk CRA, backed by receivables from a single issuer, such as a large company or a large-scale producer, and the composite CRA, which is backed by receivables from a limited (concentrated) or several (diversified) debtors. The growth of the CRA market in Brazil is also driven by the constant strengthening of the capital market, both in regulatory and operational matters, which increase the transparency, liquidity, and accessibility of these assets. According to B3, the combined volume of CRAs and CRIs saw an increase of 25.6% in one year, rising from R$ 247 billion in December 2022 to R$ 310.4 billion in December 2023. This, in turn, facilitates the raising of funds by securitization companies and the acquisition of titles by a wider range of investors, impacting the reach and financing available to agribusiness.

Thus, CRAs play a crucial role in the dynamic financing of Brazilian agribusiness, offering an efficient and flexible solution for the sector’s funding. At the same time, they present opportunities for investors looking to diversify their portfolios with safe, profitable fixed-income options that benefit from tax incentives. Recent data indicate that the stock of CRIs is almost double that of CRAs, yet the real estate sector accounts for close to 10% of the GDP, while agribusiness accounted for 23.8% of the country’s GDP, according to CEPEA. The convergence of these factors suggests that there is a potential demand not yet fully exploited and also contributes to the consolidation and diversification of the national financial market, reinforcing the position of agribusiness as a pillar of the Brazilian economy.

Authored by Tiago Piassum Theodoro, founder of Rivool Finance.

Tags

Private credit