Posted on December 15, 2023

Share:

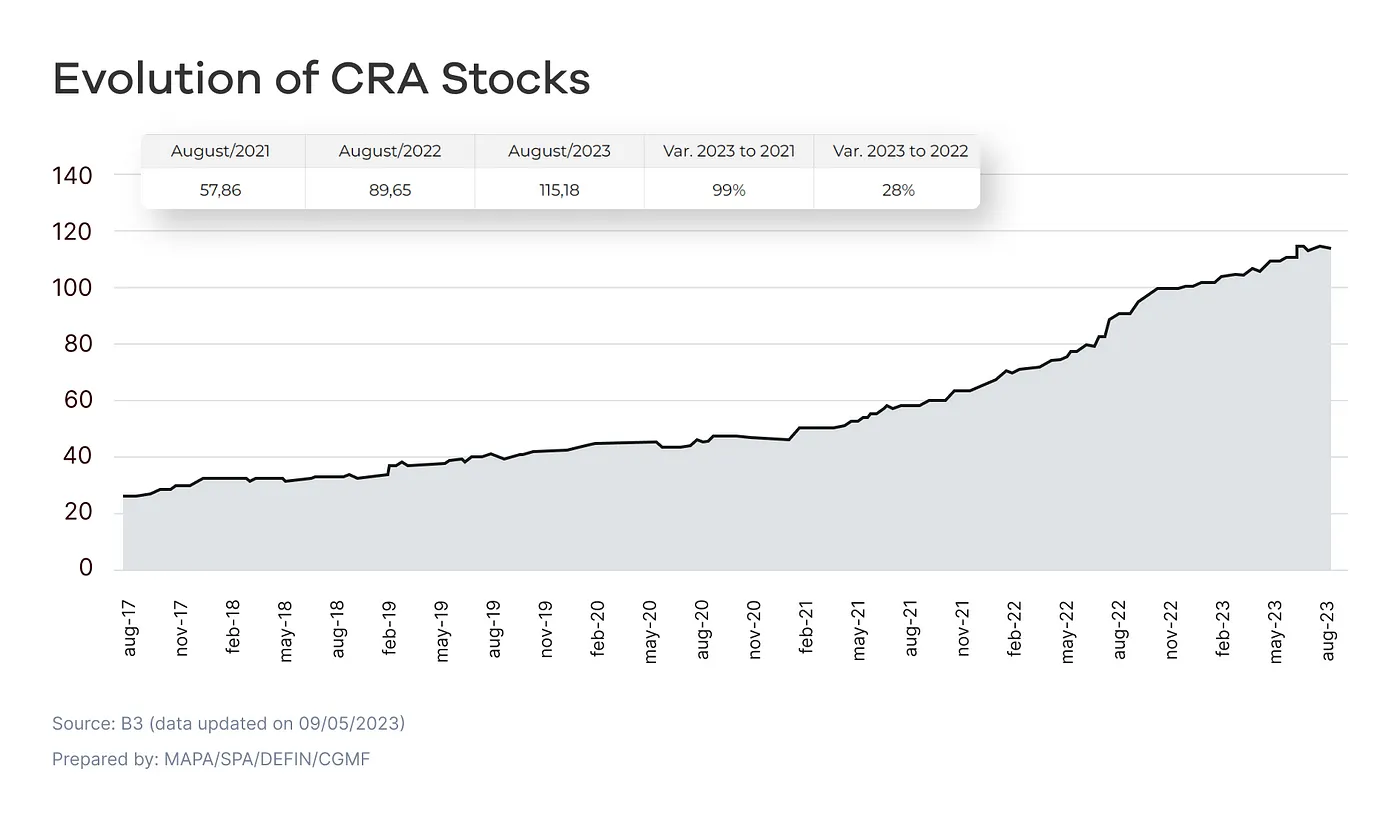

It took almost 20 years, but now it seems to be consolidating. In August 2023, the stock of CRAs reached the impressive mark of BRL 115 billion

cras-take-off-but-still-have-the-potential-to-fly-higher

CRAs take off but still have the potential to fly higher

Despite being a credit alternative for agribusiness since the enactment of Law 11,076 in 2004, Agribusiness Receivables Certificates (CRAs) took a long time to take off. It was necessary to make significant changes in the legislation to improve the process of guarantee execution and expand its scope of action to the entire agribusiness production chain. It took almost 20 years, but now it seems to be consolidating. In August 2023, the stock of CRAs reached the impressive mark of BRL 115 billion, practically triple the volume it had three years ago.

However, a more detailed analysis of issuances shows that this important source of credit for agribusiness and income for investors is still very concentrated. BRF, JBS, Marfrig, M. Dias Branco, Klabin, Raizen, and Petrobras, among other corporations, are among the leading issuers. For example, Klabin’s BRL 2.5 billion issuance alone accounted for a little more than 5% of last year’s emissions.

This reality may change as other potential demandants discover its benefits. This is because, generally, the degree of familiarization and knowledge about this potential source of credit is still low both by companies in the sector and by investors.

The CRA is a fixed-income security backed by receivables from the negotiation between cooperatives or between the rural producers themselves and third parties. Its issuance is a transaction carried out in the securities market in which the company assigns its receivables to a securitization company’s intermediary, usually with a financial institution’s help. In this way, the securitization company will pay for the receivables assigned, anticipating the receipt from the company.

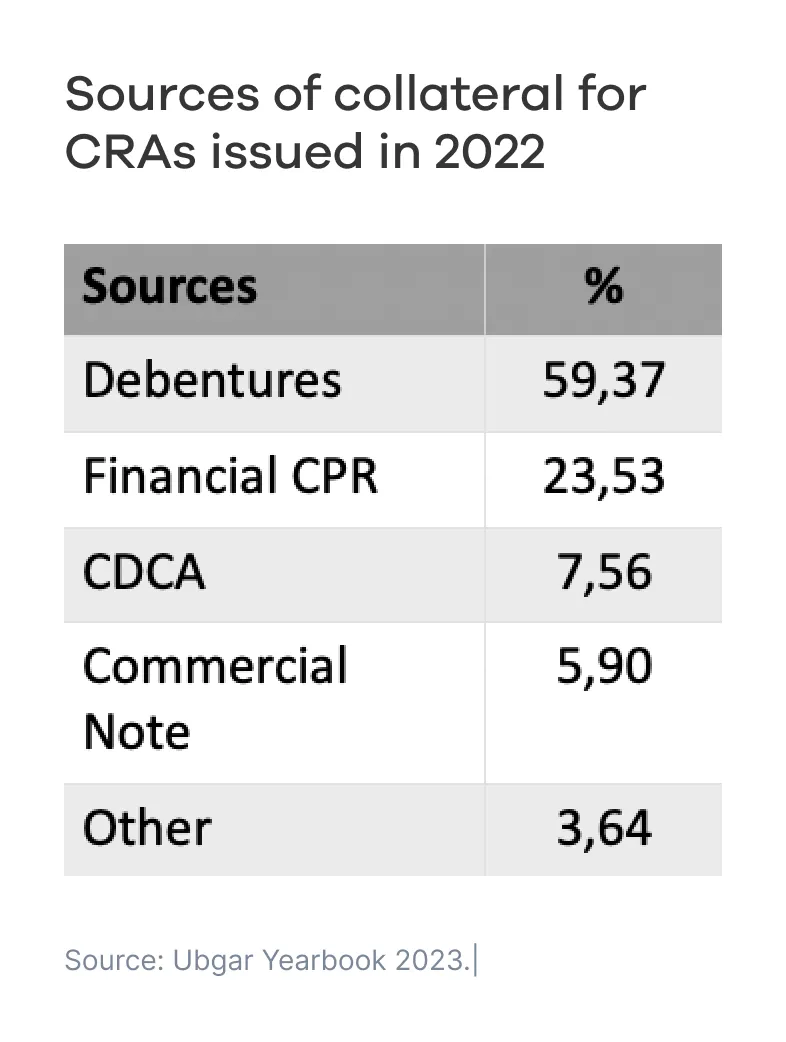

In the operation of the CRA, a variety of receivables can be used as collateral, such as Rural Product Notes (Finance CPR), Agribusiness Credit Rights Certificates (CDCA), Agricultural Warrants (WA), Export Credit Notes (NCE), Export Credit Notes (CCE), Debentures or Promissory Notes and other receivables originated in the chain (commercialization of inputs, logistics services, partnerships, leases, etc.). The 2022 figures show that debentures collateralize a significant part of the CRAs. This reinforces the idea that this credit alternative is still very concentrated in large corporations.

Among the main benefits of CRAs for companies in the sector is the possibility of obtaining cheaper credit and for a longer payment term than the production cycle, something that allows, among other things, the company to use credit in its expansion planning. Of course, the lower cost of credit depends on a prior risk assessment by the securitization company. However, in principle, there are good reasons to believe that CRAs are among the lowest-cost credit alternatives because they are a security with tax benefits. The investor income (individual) is exempt from Income Tax withheld at source and in the annual return, regardless of the certificate issuance date. In addition, the Financial Transaction tax rate (so-called IOF) is zero on acquisition, assignment, transfer, and exchange operations related to investments in CRA.

All these factors contribute to reducing the cost of credit for borrowers and allow the cost of credit to be lower in many cases than that obtained from financial institutions, even though these securities are almost entirely post-fixed and indexed to the Brazilian CPI (IPCA) and short-run bonds rate (CDI). Something that usually occurs when these indexers are at lower levels than they currently are.

Another advantage of CRAs is the company’s exposure to the capital market. Once a CRA is issued, the market monitors the company’s behavior, something that can generate new partnership opportunities for new investments. The lack of knowledge of companies and their numbers is one of the main barriers to entry into the capital market. However, to the extent that companies invest in processes that make their accounts more transparent and accessible to potential investors, the possibilities for the private credit market to expand and benefit more and more companies increase.

For those smaller companies or those still unknown to the market, an alternative for entering the capital market may be, for example, the pulverized CRA. There are two types of CRA structures: (i) the single-risk CRA, when the receivables are from a single company or a large producer, and (ii) the diversified CRA, whose backing is formed by a few (diversified CRA — concentrated) or many (diversified CRA — pulverized) debtors.

The pulverized CRA is important because it can bring resources to several companies that would not have the opportunity to raise the volume or rate at which they grow based only on their numbers. In this case, the risk assessment is based on a group of securitized assets rather than on the receivables of a specific company. Thus, in addition to obtaining a resource at a lower cost, the company gains exposure by becoming part of the securitization company’s database. This allows, for example, creating the conditions for issuance under more favorable conditions of credit cost and term or facilitating a future process to turn a corporation.

Regarding a possible concern of companies with the demand for these securities, it is essential to note that the CRA market is still very far from reaching its potential. There are a few reasons to believe this. Firstly, because the size of the private rural credit market is still far from its counterpart in the real estate market, both Agricultural Funds (Fiagros) are still far behind Real State Funds (FIIs), and CRA issuances are lagging behind Real State securities (CRIs). The latest numbers indicate that the stock of CRIs is around BRL 200 billion, i.e., almost double that of CRAs. However, the real estate sector’s share is around 10% of GDP, while the share of agribusiness is more than double that. Secondly, since 2020, Law 13,986 allows the issuance of CRAs in foreign currency. Therefore, there is a potential demand that has not yet been adequately explored and that, at this moment, is still challenging to measure. Thus, CRAs cannot be ruled out: they can be the gateway of agribusiness (the sector of the Brazilian economy most integrated into the global market) into the international capital market.

Authored by

Cristiano Oliveira, Associate Professor at the Federal University of Rio Grande — FURG andHead of Research at Rivool Finance.

Tags

Private credit