Posted on October 11, 2023

Share:

The mechanism behind Fiagro is straightforward: income generated from the sale or lease of rural properties is periodically distributed to its shareho

fiagro-redefining-agribusiness-investment-landscape

FIAGRO: Redefining Agribusiness Investment Landscape

Established in December 2021, Fiagro’s structure resembles real estate funds but with enhancements tailored for the agricultural sector. The mechanism behind Fiagro is straightforward: income generated from the sale or lease of rural properties is periodically distributed to its shareholders. However, this distribution is not automatic; it adheres to a predefined schedule.

As of June 2023, Fiagro has become a significant source of financing for the agribusiness segment, amassing a portfolio of BRL 8.7 billion with over 308,000 investors.

In contrast to real estate funds, Fiagro’s distribution policy lacks regulatory constraints. The fund’s administrators establish the distribution guidelines, with most Fiagro managers opting for a monthly income distribution protocol. This protocol is akin to that of traditional real estate funds, where income can also result from asset distributions and capital gains derived from the purchase and sale of assets.

Fiagro can be structured as either an open-end fund for over-the-counter issues or a closed-end fund for stock market operations. For listed market offerings, there is no fixed maturity date; hence, the investment remains open-ended. In this context, when investors choose to exit the fund, their sole recourse is to sell their shares on the secondary market.

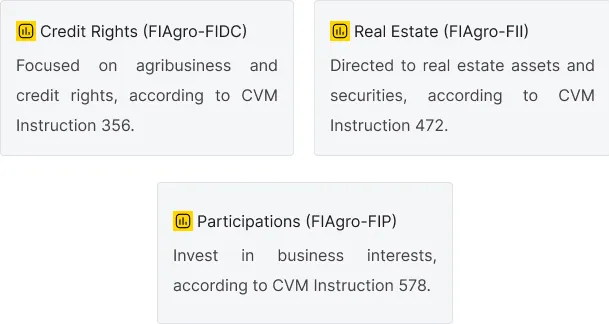

In essence, Fiagro functions as a collective investment vehicle that pools resources from multiple investors to engage in assets related to agribusiness, encompassing rural properties and activities within the sector. The fund retains the flexibility to diversify across various asset classes, including credit rights, real estate, securities, and business interests, provided they are linked to the agro-industrial production chain. In accordance with CVM Resolution №39, Fiagro can be categorized into three groups:

Furthermore, investors do not incur income tax on yields if Fiagro shares are exclusively traded on organized exchanges or over-the-counter markets, provided the fund maintains at least 50 shareholders. For non-resident investors, Fiagro presents a unique opportunity for portfolio diversification, offering access to Brazil’s stable and internationally integrated agribusiness sector, renowned for its growth potential. Additionally, non-resident investors may benefit from substantial tax advantages, particularly when specific conditions exempt individuals from income tax on their earnings.

Since its inception, the number of agribusiness funds has seen remarkable growth. These funds offer diverse investment options, with the flexibility to structure investments in various agribusiness-related assets, including credit rights, real estate, and business holdings. Notably, FIAgros’ primary investments have been directed towards CRAs. According to CVM data, the largest FIAgros vehicle, FIAgros-FII, held a net worth of BRL 8.8 billion in December 2022, with over 65% of its assets allocated to CRAs and 13% in cash or cash equivalents.

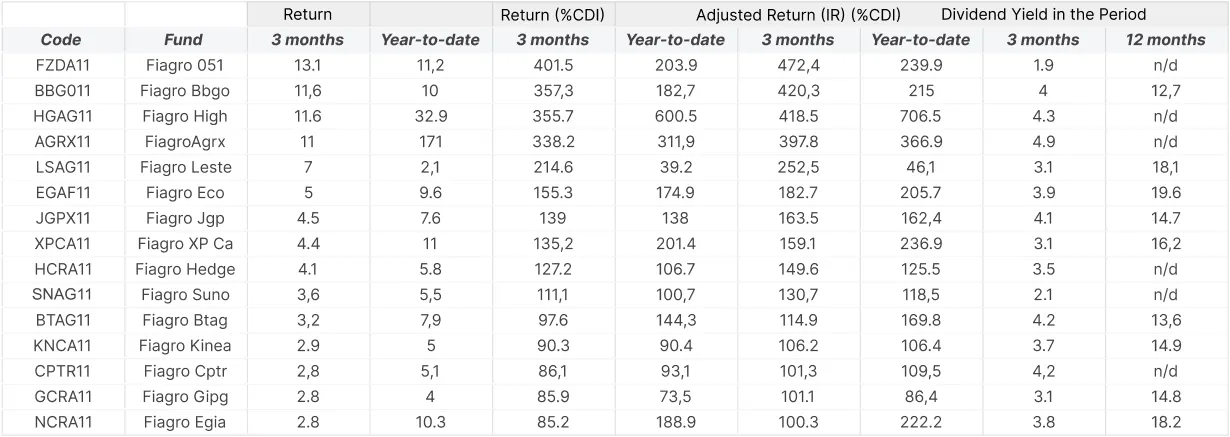

Despite the challenges faced by the fund sector in 2022, FIAgros leveraged rising interest rates to deliver attractive returns, typically tied to post-fixed assets. This development democratized access to the highly lucrative Brazilian agribusiness sector, historically dominated by institutional and professional investors. The table below illustrates quarterly and annual returns (as of January 2022) as a percentage, in comparison to the CDI rate, alongside the CDI rate adjusted for Income Tax deductions. The “IR Adjustment” calculation assumes a 15% income tax rate. Quota values for these calculations correspond to the closing figures on June 21, 2023.

Although the Brazilian market has recently standardized this asset class, FIAgros exhibit noteworthy liquidity and evident potential for appreciation. The Banco Central (Bacen) signaling its intent to continue reducing the SELIC rate adds to this potential, as it is poised to attract fixed income investors towards equity investments.

In this environment of declining interest rates, coupled with the sector's considerable growth potential and clear regulations, we anticipate an influx of new players entering the private credit market in agribusiness. This, in turn, will stimulate the launch of new FIAgros and attract capital to existing ones.

In conclusion, Fiagro represents a strategic and profitable alternative, enabling global investors to enter the Brazilian agricultural market with an attractive return outlook and a consistent income distribution policy overseen by the fund manager.

Authored by

Tiago Piassum Theodoro, Founder of Rivool Finance.

Tags

Private credit