Posted on October 29, 2023

Share:

A greener and more environmentally responsible world will need inputs and products that will probably come from a region remembered more for its

is-south-america-the-land-of-(green)-opportunities

Is South America the land of (green) opportunities?

Despite all the technological advances, the world is constantly facing new challenges. The goal of sustainable development imposes new demands that need to be met. The search for cleaner sources and use of energy and ways to produce food sustainably puts the focus on two sectors: mining and agriculture. A greener and more environmentally responsible world will need inputs and products that will probably come from a region remembered more for its political and economic instabilities than for its potential for economic growth: South America.

In 2015, the Paris Agreement set long-term temperature targets to reduce climate change’s potential impacts and risks. To limit global warming to 1.5°C with a 50% probability, global cumulative CO2 emissions commit countries to reach net-zero CO2 emissions by the middle of the 21st century. This has led many countries to look differently at products and inputs that would allow them to achieve these goals.

One such product is electric cars. Recent European Union legislation requires all new vehicles sold to have zero CO2 emissions by 2035 and 55% fewer CO2 emissions by 2030 than 2021. The targets are intended to drive the rapid decarbonization of new car fleets in the 27-country bloc.

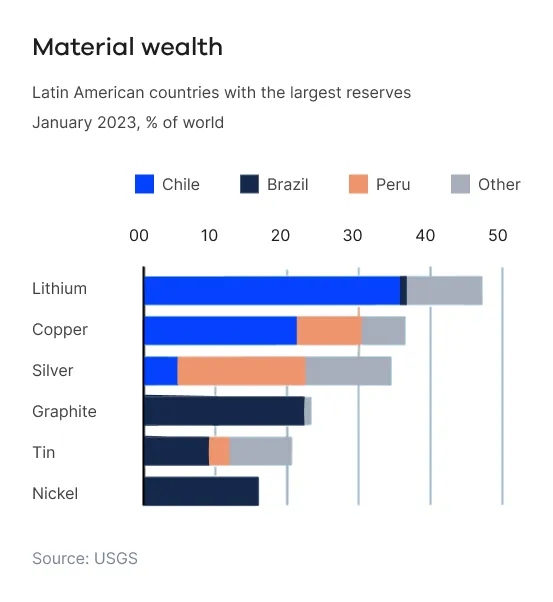

However, this massive adoption of electric vehicles requires the extraction of minerals that European countries do not have. Low-carbon technologies are far more mineral-intensive than their dirtier counterparts. An electric vehicle contains three to four times more copper than a gasoline-powered car and uses batteries, which requires a rare mineral found abundantly in South America: lithium. The region has about 60% of the world’s known lithium.

The importance of the region for lithium production goes beyond its abundance. Extraction of the mineral in South America is more straightforward to extract than anywhere else. It is cheaper to obtain lithium by evaporation than to remove it from rocks, as in Australia and China. As is well known, mining and processing minerals consume a lot of energy. However, many South American countries can take advantage of cheap electricity generated from renewable sources.

To meet the goals of the Paris Agreement to combat climate change, the share of clean energy technologies in total demand will require an increase over the next two decades by more than 40% for copper extraction and nearly 90% for lithium, according to the International Energy Agency (IEA). Wood Mackenzie, a specialist mining company, estimates that by 2040, at least USD 575 billion of investment will be needed to meet global copper demand. By 2030, nearly USD 40 billion will be required for lithium. Last year, more money was spent in Latin America than elsewhere on exploiting the minerals that underpin the so-called “Green Economy.”

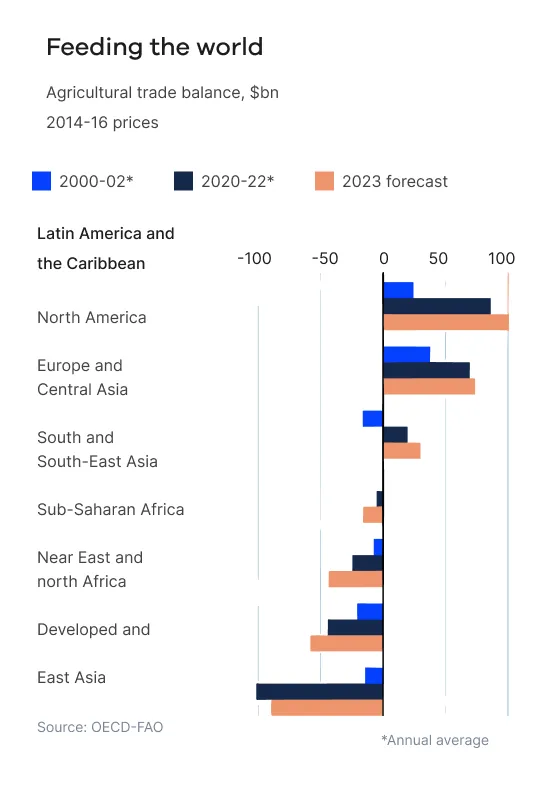

On another front, agriculture is highly exposed to the impact of rising global temperatures. Increasing fluctuations in seasonality disrupt agricultural cycles, while substantial challenges arise from changing rainfall patterns and extreme weather events such as heatwaves, droughts, storms, and floods. Sustainable agriculture seeks to ensure farmers can adapt to climate uncertainty, reduce emissions, and mitigate climate change to produce the food needed to alleviate world hunger. A 2020 FAO report concluded that global food security poses the challenge of producing about 70% more food by 2050 to feed about 9 billion people.

Although the entire region has potential, for example, in fruit production in Chile and Argentina and livestock and dairy products in Uruguay, in South America, the powerhouse in food production in Brazil. It is a country with ample reserves of land and water. The country has a lot of uncultivated land with the potential for future agricultural production. The United States Department of Agriculture’s (USDA) Agricultural Projections for 2031 indicate that an additional 20 million hectares of farmland will be put into production by 2031 in the country, an annual expansion rate of 2.6%. This would be one of the fastest rates of farmland expansion in the world.

According to USDA projections, to meet projected demand from consumers and importers of corn and soybeans, such as China, Brazil will need to produce 76% more grains and 41% more oilseeds over the next decade. Meat and poultry production is expected to increase by 9 tons (around 15%) by 2031. The forage grains needed to meet this demand growth are expected to increase to more than 105 million tons, 17% more than consumed in 2021.

Brazil’s soybean exports are forecast to increase by 42.6 million tons (45.6%) to 136.1 million over the next ten years, strengthening its position as the world’s leading exporter. Soybean production remains more profitable than other crops in most areas of Brazil. With the increase in plantations in the Cerrado region and production extending to the Legal Amazon region, the growth rate in the area planted with soybeans is expected to be more than 2% per year over the next decade.

However, the country suffers from deficiencies in the logistics and warehousing sectors. The demand for investments is significant. In the warehousing sector alone, an investment deficit accumulates annually in the order of at least USD 1 billion. This growth could certainly accelerate if Brazil innovates agricultural practices and technologies to develop storage facilities and transportation infrastructure.

Faced with this demand for investments, it is necessary to recognize that the standards for financing the South American economy are outdated. Small and medium-sized enterprises and producers have virtually no access to long-term financing and credit, which depend entirely on state-owned banks. An alternative to meet this demand for investments that can overcome sustainability challenges has been classifying products as “green.”

Green-labeled products have become globally recognized as an effective means of directing investment capital to climate change mitigation, resilience, and adaptation projects. Thus, investors’ growing interest in projects of this type has resulted in the development and growth of innovative financial products, including green, social, ESG, sustainability, and green index products.

Therefore, South America has great potential for this “green” credit market due to its ability to meet the demands for products and inputs necessary for the environmentally sustainable development goals set by developed countries to be achieved. These profitable sectors can pay attractive interest rates to investors willing to take advantage of this potential boom generated by the Green Economy, in which South America presents many opportunities.

Autored by

Cristiano Oliveira, Associate Professor at the Federal University of Rio Grande — FURGandRivoolcollaborator.

Tags

Private credit