Posted on October 4, 2023

Share:

This article explores the compelling data and insights that reveal the hidden strengths of private credit. Discover how it thrives in turbulent times

private-credit-investment-unleashing-opportunities-for-growth

Private Credit Investment: Unleashing Opportunities for Growth

In today’s volatile economic landscape, private credit shines as a beacon of financial resilience and opportunity. This article explores the compelling data and insights that reveal the hidden strengths of private credit. Discover how it thrives in turbulent times, delivering stability and growth potential even when other investments falter.

Navigating the World Economy Amidst High Inflation: The attraction of Private Credit

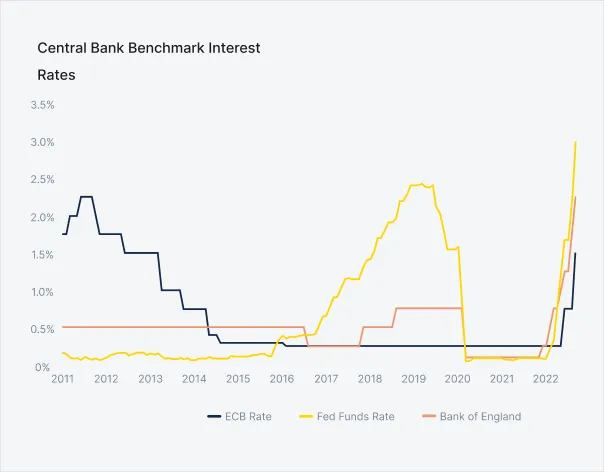

However, a consensus is emerging among major central banks worldwide: high inflation rates are a looming threat. Thus, combating inflation has become a top priority for developed economies. Many central banks are adopting restrictive monetary policies expected to persist. This means no abrupt interest rate cuts in the short term. The rationale? Inflation accelerates rapidly but decelerates slowly, as monetary policy responses tend to be delayed and gradual.

Amidst high interest rates, low growth, and elevated inflation — a terrain unfamiliar to many investors — exploring alternative investment options is imperative. The global investment landscape is undergoing a transformation, with private credit emerging as a savvy choice for long-term allocation.

Private Credit: A Smarter Investment Choice

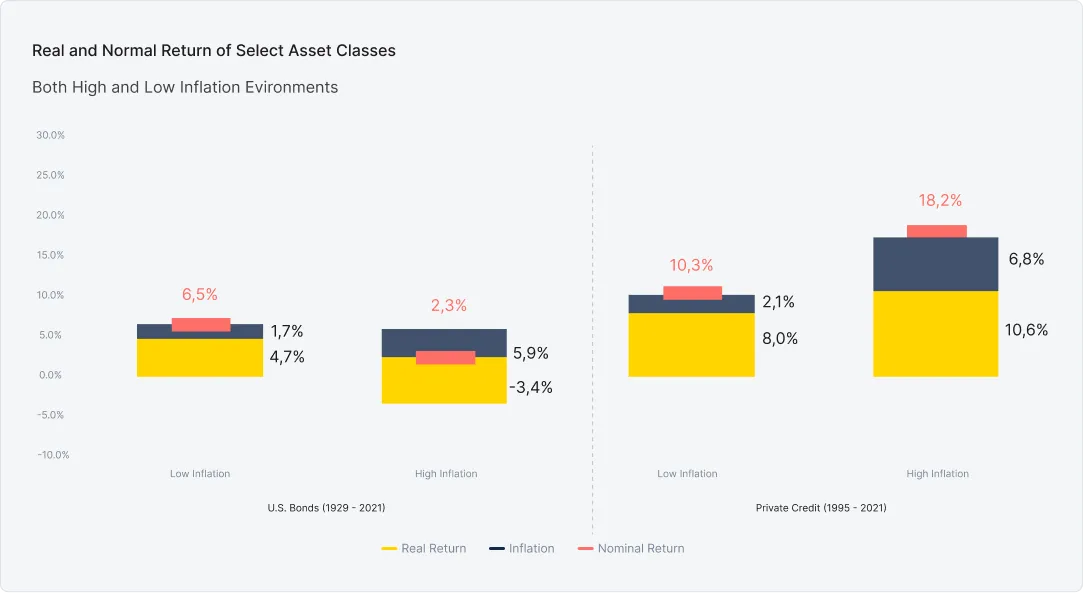

In the current economic climate, many investors may believe that government bonds are their safest bet. However, historical data compiled by Hamilton Lane suggests that government bonds often yield negative real returns in high inflation scenarios. In stark contrast, private credit investments tend to offer positive and higher returns, particularly in periods of high inflation.

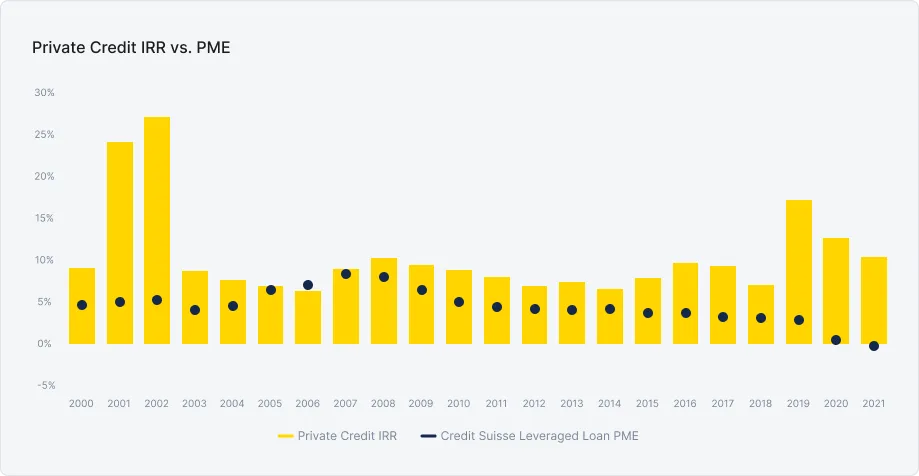

What’s more, Hamilton Lane’s research demonstrates that private credit has consistently outperformed leveraged loans over the past two decades. The chart below illustrates the average net Internal Rate of Return (IRR) of all our private credit funds, shown in yellow, alongside the potential returns represented by black dots if the same capital had been invested in the public leveraged loan market. The differences in returns are striking, and they’ve only grown more pronounced, especially in recent times marked by a challenging environment with increased delinquency rates. It’s clear that private credit stands out as an attractive and resilient investment alternative.

In times of economic uncertainty, it’s crucial to explore investment options that not only preserve wealth but also generate meaningful returns. While government bonds may seem like a safe haven, their performance often falters in the face of rising inflation. Private credit, on the other hand, offers a compelling solution with its track record of delivering positive returns even during high inflationary periods.

Why Credit Markets Shine in Turbulent Times

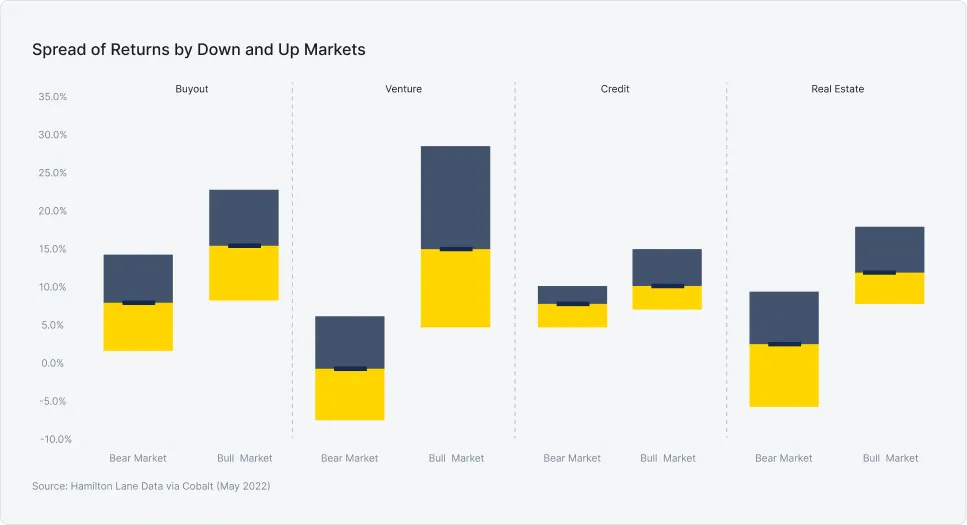

Hamilton Lane’s extensive survey, cataloging data from approximately 50,000 private funds in its database, unveils a promising insight: the credit market tends to be less volatile and, consequently, safer when stock markets are on a downward spiral. This safety extends to credit markets’ resilience even during periods when the housing market, a sector highly sensitive to interest rates, sees property prices plummet in recessionary periods.

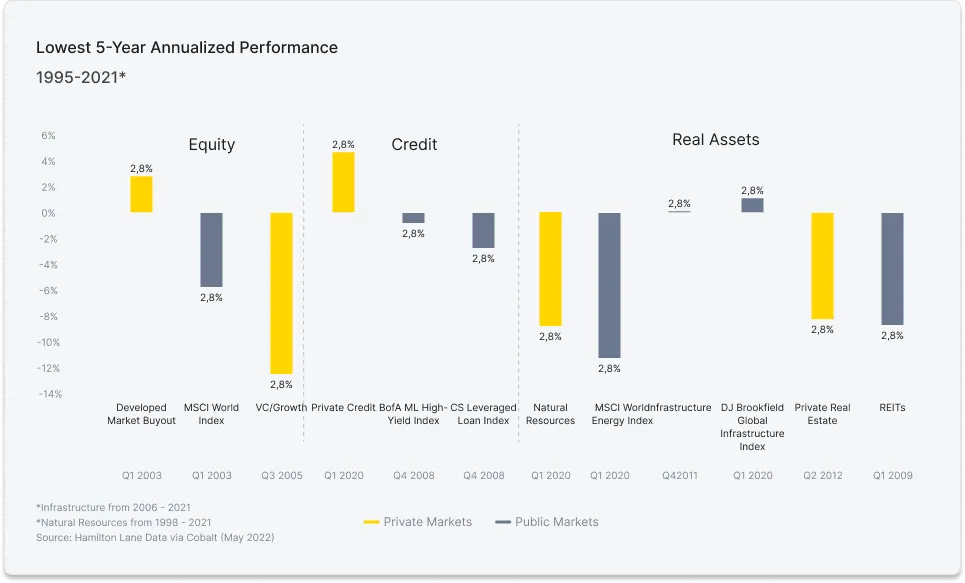

Moreover, Hamilton Lane’s research sheds light on another compelling aspect. Among various asset classes, only private credit and developed market buyouts consistently deliver significant positive returns when considering a five-year horizon, even amidst the worst performances of equities, credit, and real assets. This underscores the consistent strength and reliability of private credit as an alternative investment to safeguard against losses.

Why do we believe in the Potential of Private Credit?

In a world of economic uncertainties, where market conditions can change rapidly, the resilience and reliability of private credit shine as a beacon of hope for investors. As we’ve explored the data and insights, it becomes abundantly clear that private credit offers a unique combination of stability and opportunity.

In times of stock market volatility and rising interest rates, private credit has consistently demonstrated its ability to weather the storm, providing a safe harbor for investments. While recessions may rattle other asset classes, private credit has proven its mettle by delivering positive returns even during the most challenging economic downturns.

Furthermore, the comparison with other asset classes, such as government bonds and leveraged loans, highlights the remarkable strength of private credit as an investment choice. Its track record of outperforming in high-inflation scenarios and providing significant positive returns over extended periods sets it apart as a reliable strategy to safeguard against losses.

In conclusion, the power of credit, specifically private credit, lies in its ability to provide stability and seize opportunities, making it an invaluable asset in any diversified investment portfolio. As we navigate the ever-changing financial landscape, the smart investor recognizes that the strength and resilience of private credit can help unlock the full potential of their investments, ensuring financial security and growth in a volatile world.

Authored by:

Tiago Piassum Theodoro, Founder of Rivool Finance.

Tags

Private credit