Posted on November 14, 2023

Share:

Over the past decade, the digital currency landscape has evolved dramatically. From Bitcoin’s inception in 2008, cryptocurrencies have transitioned

regulation-and-innovation-in-digital-currencies-a-financial-perspective

Regulation and Innovation in Digital Currencies: A Financial Perspective

Over the past decade, the digital currency landscape has evolved dramatically. From Bitcoin’s inception in 2008, cryptocurrencies have transitioned from speculative assets to significant players in the financial system.

This transformation has prompted a regulatory revolution worldwide, as governments seek to balance the innovative potential of these digital assets with the need for consumer protection and market stability.

The Current State of Crypto Regulation

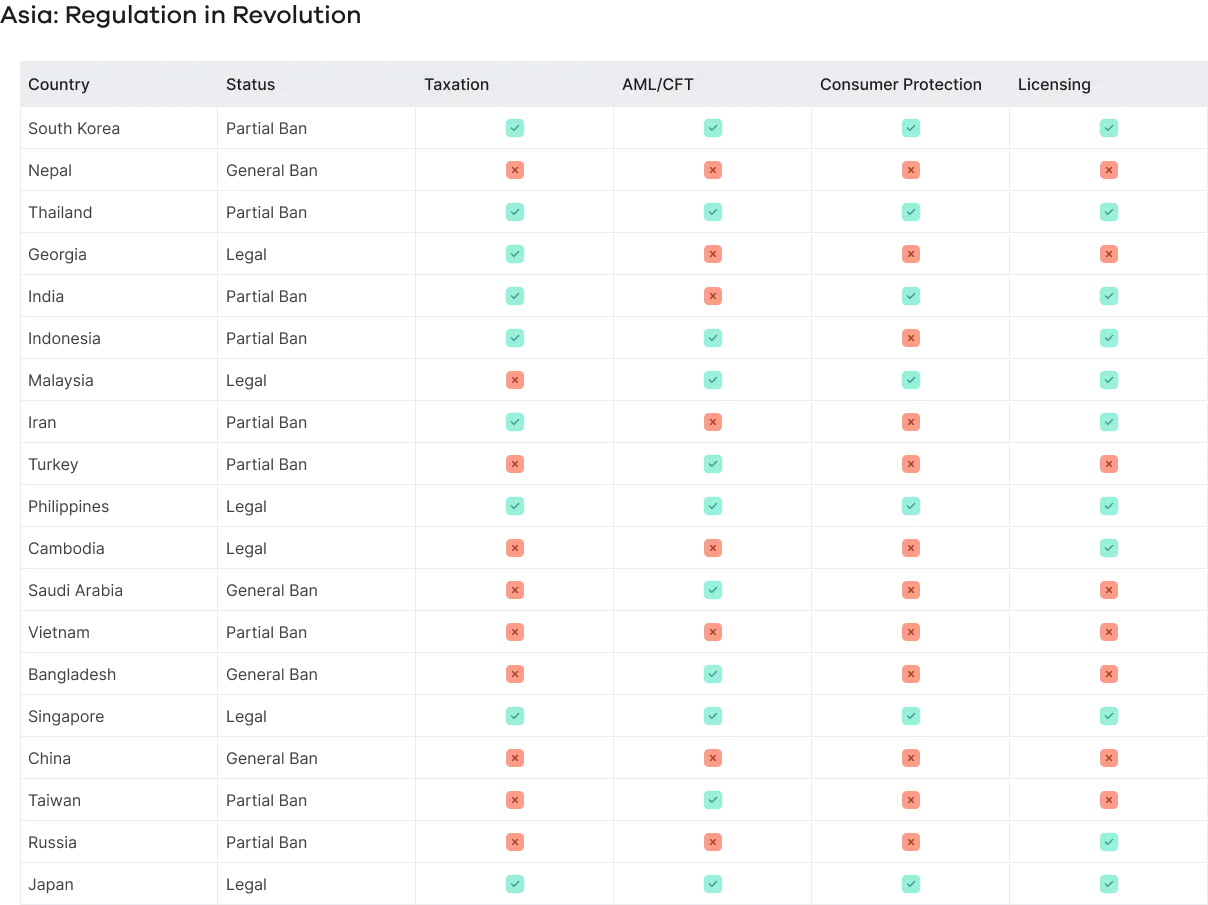

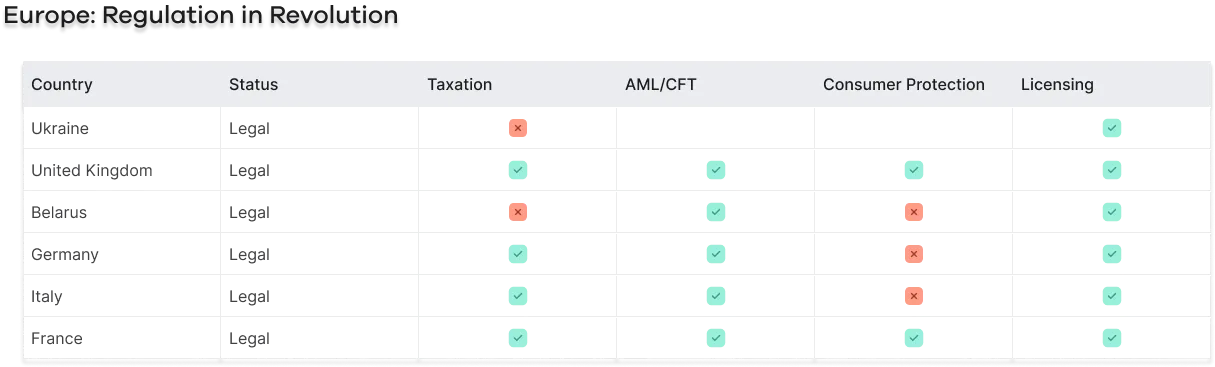

A study of 45 countries, including G20 nations and those with rising crypto adoption, reveals that nearly 75% are in the process of substantially revising their regulatory frameworks, specifically targeting cryptocurrency markets. Notably, stablecoins, often backed by fiat currencies, have emerged as the new frontier in crypto regulation.

In terms of overall regulatory development, advanced economies are ahead, with 64% having established regulations covering taxation, anti-money laundering/countering the financing of terrorism (AML/CFT), consumer protection, and licensing. This contrasts sharply with just 11% of emerging economies.

Global Trends and Challenges

The G20 nations exhibit diverse responses to cryptocurrencies, ranging from outright bans to full legalization. However, they share a common recognition of the disruptive potential of digital currencies and the consequent need for oversight. Within these economies, cryptocurrencies are fully legal in ten countries. The swift evolution of crypto-asset regulations underscores the delicate balance governments must strike between fostering innovation and ensuring market integrity.

Interestingly, there is a weak correlation between a country’s cryptocurrency adoption rates and the rigor of its regulatory framework. Many countries with high adoption rates maintain partial or total bans on cryptocurrencies. This paradox reflects the global experimentation with regulatory “sandboxes,” allowing nations to test and collaborate with the private sector in a controlled environment. In the tables below, we can observe this correlation by comparing the state of cryptocurrency regulation in Europe and Asia.

The Road Ahead: Innovation in Financial Asset

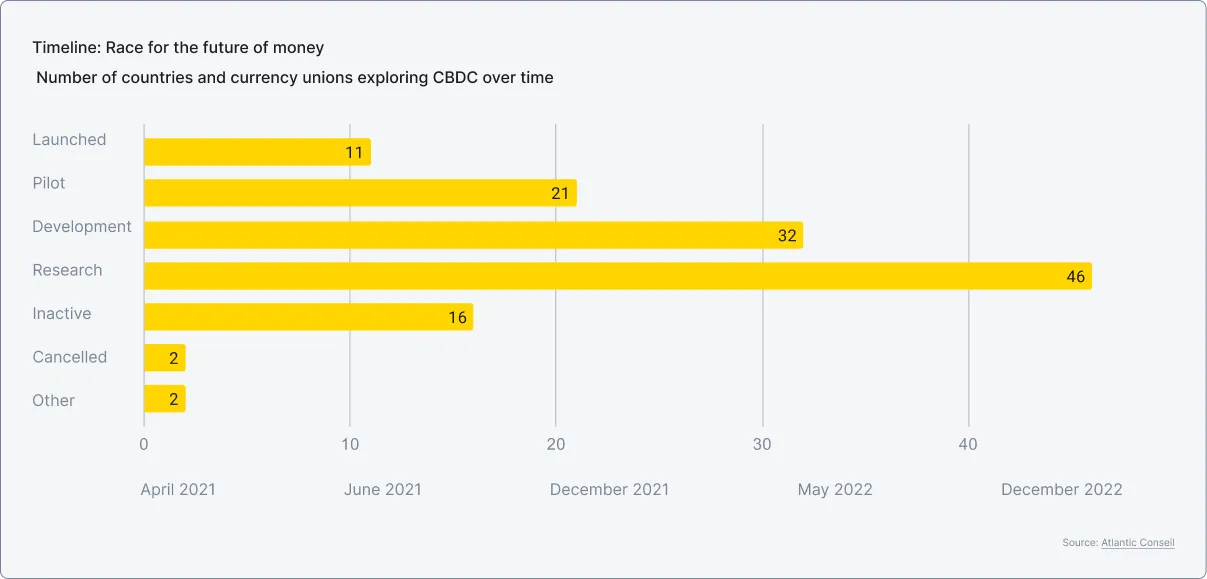

Looking forward, the focus shifts to the financial origination market, poised for a transformative overhaul akin to the revolution fintechs brought to services like foreign exchange and credit. With 12 cross-border initiatives exploring central bank digital currencies (CBDCs), the race for the future of money is well underway. This marks a pivotal moment in financial history, as the integration of technology and policy promises to redefine how global finance operates.

The new digital race

In a remarkable demonstration of digital transformation, 131 nations, representing a staggering 98% of global GDP, are now engaged in the development of central bank digital currencies (CBDCs). This is a dramatic leap from the 35 nations in May 2020. Of these, 64 are at the forefront, deep in the development phase, running pilots, or have already launched. The G20 is not lagging behind in this digital race. An impressive 19 of its members are navigating the advanced corridors of CBDC design, with 9 already in the testing phase. Over the past six months, there has been a steady increase in resources and progress among these economic powerhouses.

China is exploring every possibility in its expansive pilot. Covering 260 million of its citizens, the program is testing the utility of digital currency in more than 200 real-world scenarios, from public transportation fares to e-commerce transactions. The European Central Bank is gearing up, with a digital euro pilot on the horizon. As 2023 approaches, more than two dozen countries, including powerhouses like Australia, Thailand, and Russia, are gearing up for CBDC pilots. Meanwhile, India and Brazil are eyeing a 2024 launch.

Although retail CBDC momentum in the U.S. appears to have paused, its G7 counterparts, led by the Bank of England and the Bank of Japan, are in full swing — drafting CBDC projects and launching extensive consultations on concerns such as user privacy and financial stability. The US focus may have shifted to the area of wholesale CBDCs, particularly for interbank transactions. The geopolitical tensions witnessed during Russia’s incursion into Ukraine and the subsequent G7 sanctions have unexpectedly accelerated wholesale CBDC projects. Currently, 12 cross-border initiatives are being explored.

The Global March of Cryptocurrencies

In the ever-evolving landscape of digital currencies, the convergence of innovation and regulatory dynamics defines a new era in finance. As the global march of cryptocurrencies continues, businesses at the forefront understand the delicate balance required to navigate this complex terrain.

In recognizing the potential of digital currencies and the pivotal role of regulation, we find ourselves in the midst of a transformative journey. The ongoing development of central bank digital currencies (CBDCs) underscores a global commitment to reshaping financial landscapes.

This era demands adaptability and foresight, and those poised to thrive are the ones leveraging innovative technologies responsibly. The journey may be complex, but it presents opportunities for businesses to embrace change, ensuring compliance with evolving regulations while offering secure and efficient access to dynamic markets.

As we navigate this intricate dance between technology and policy, businesses are not mere spectators; they are active participants in shaping the future of finance. The march of cryptocurrencies is a call to innovation, and those who answer will be instrumental in defining a landscape where progress is fueled by both opportunity and regulatory responsibility.

Authored by

Tiago Piassum Theodoro

Founder of Rivool Finance

Tags

Private credit