Posted on November 3, 2023

Share:

Rivool’s innovative Smart Score emerges as a transformative solution, aiming to bridge the credibility gap and offer reassurance to investors seeking

smart-score-solving-the-problem-of-risk-analysis

Smart Score: Solving the problem of risk analysis

In the investment landscape of Latin America, a prevalent concern arises from the perceived lack of credibility within credit rating agencies. This hesitation often deters many investors from actively engaging in the region’s markets. Addressing this challenge, Rivool’s innovative Smart Score emerges as a transformative solution, aiming to bridge the credibility gap and offer reassurance to investors seeking opportunities in Latin America.

Smart Score

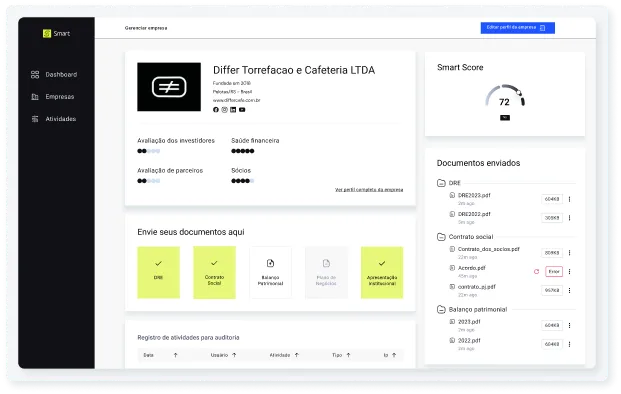

The Smart Score is our innovative solution to the prevalent issues within the risk rating agency model, aiming to resolve conflicts of interest and bridge the information gap between issuers and investors. It incorporates an advanced credit risk analysis methodology that amalgamates due diligence metrics, financial analysis, and ongoing risk monitoring for companies.

Through the analysis of submitted data and ensuring issuer accountability for the accuracy of provided information, our evaluation process is automated. It operates on principles designed to eliminate conflicts of interest. This structured methodology not only streamlines evaluations but also champions transparency within the digital asset credit ecosystem. It ensures that investors have access to trustworthy and impartial information.

Metodology

The Smart Score Credit Methodology is segmented into three key sections, each assigned a specific weight: Operations and Due Diligence, Financial Analysis, and Risk Monitoring. Collectively, these sections construct a comprehensive evaluation of a commercial company’s creditworthiness. They furnish vital insights into operational efficiency, financial stability, and the efficacy of the company’s ongoing risk management.

Our Approach

Within the Rivool Finance platform, our network of platform partners plays a pivotal role in providing essential information for each issuer, receiving in return an automated Risk Score. This streamlined process involves fulfilling the KYB (Know Your Business) requirements, submission of reported financial details, and the completion of the DDQ (Due Diligence Questionnaire).

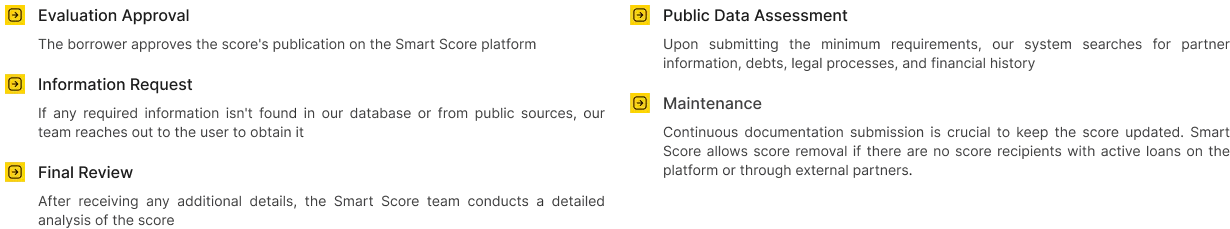

The Credit Assessment process encompasses the following stages:

Smart Score’s Credit Analysis Features

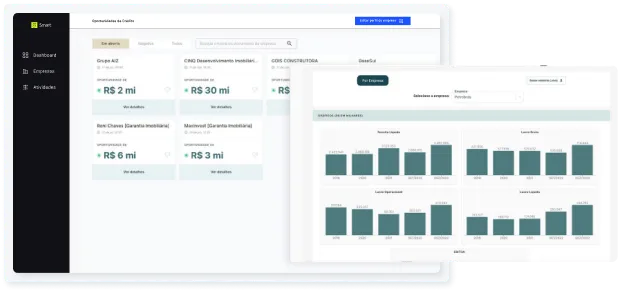

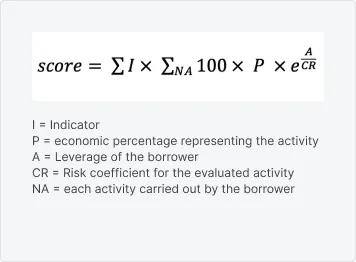

Our system incorporates leverage analysis as a fundamental component. It involves the mapping of each business activity against historical data, subsequently recalibrating our score in accordance with the company’s exposure to leverage. An upsurge in leverage corresponds to heightened financial risk, with varying levels of risk across different activities at a given leverage threshold.

Each indicator is individually computed based on responses and historical analysis drawn from publicly traded companies. The summation of these indicators, multiplied by the leverage index (which represents the average of borrower’s activity indices), culminates in our final Smart Score calculation.

Source: Credora

Outcome: Pursuing Efficiency and Manageable Risk

Recognizing the pivotal role of a company’s financial well-being in credit approval, we categorize issuers based on their score. This segmentation offers investment managers a transparent overview of the risk associated with Rivool’s partners and it will be a will be a great analytical differential.

Authored by

Founder of Rivool Finance

Tags

Private credit