Posted on April 23, 2024

Share:

As the agricultural sector advances, the management of rural credit faces increasingly greater challenges, demanding innovations that not only reduce

the-future-of-rural-credit-management

The Future of Rural Credit Management

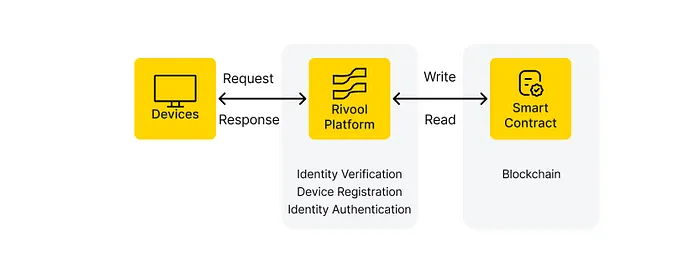

As the agricultural sector advances, the management of rural credit faces increasingly greater challenges, demanding innovations that not only reduce costs and enhance security but also significantly improve operational efficiency. The emergence of blockchain-based smart contracts promises a profound transformation in these operations, redefining traditional credit interactions and bringing greater transparency and security to investors and managers.

Smart contracts are essential because they are self-executable within the blockchain infrastructure, automatically executing contractual terms when pre-established conditions are met. This automation eliminates the need for intermediaries, reducing administrative and processing costs. In the context of rural credit, this translates into faster and more cost-effective contract executions, minimizing human errors and fraud.

A practical example of this is the adoption of the ERC-3643 standard on Ethereum, which facilitates the tokenization of real assets in a compliant manner. This allows for the digitalization of agricultural rights and products, increasing liquidity and access to global markets, breaking traditional barriers that often limit smaller-scale farmers.

The security, a key benefit of blockchain, stems from its decentralized and immutable nature. Once a contract is recorded on the blockchain, it cannot be retroactively altered, ensuring that the agreed-upon terms remain intact and immune to manipulation, which strengthens trust among all parties involved.

Furthermore, smart contracts can be configured to include automatic checks for eligibility and regulatory compliance, using standards such as ERC-725, ERC-734, and ERC-735 to verify identities. This capability is crucial in a regulated environment like rural credit, where compliance needs to be rigorously monitored and ensured.

According to analyses by Roland Berger, asset tokenization is projected to grow into a $10 trillion market by 2030. For the rural credit sector, this technology represents an unprecedented opportunity to access new markets and capital, fostering sustainable development and agricultural expansion.

Therefore, the incorporation of smart contracts and blockchain into rural credit management is more than just a technological innovation; it is a fundamental reshaping of business principles, promising to impact how credit is managed in the sector. As these technologies gain adoption, they are expected to bring operational efficiency, security, and transparency, benefiting all stakeholders involved in agribusiness.

Authored by Tiago Piassum Theodoro, founder of Rivool Finance.

Tags

Private credit