Posted on July 25, 2024

Share:

Tokenization is converting ownership rights in an asset into a digital token on a blockchain. This advancement in blockchain technology has led to the

tokenization-in-finance-exploring-the-current-trends-and-future-of-real-world-assets-and-private-credit

Tokenization in Finance: Exploring the Current Trends and Future of Real-World Assets and Private Credit

Tokenization is converting ownership rights in an asset into a digital token on a blockchain. This advancement in blockchain technology has led to the emergence of tokenization of Real-World Assets (RWAs) as a significant trend, with the potential to revolutionize traditional financial markets. RWAs, including real estate, commodities, and private credit, can be digitized and traded on blockchain platforms. The significance of tokenizing RWAs is its power to democratize investment opportunities, enhance liquidity, and reduce transaction costs, thereby offering a new horizon in the financial world.

Tokenization is a groundbreaking process that converts both physical and non-physical assets into digital tokens, ready to be traded on blockchain platforms. This innovative approach harnesses the power of blockchain technology to create a secure, transparent, and highly efficient system for asset management and transactions. By breaking down assets into smaller, tradable units, tokenization enables fractional ownership, opening up previously inaccessible markets to a wider range of investors. Real-world assets (RWAs) are tangible and intangible assets with intrinsic value in the physical world, such as real estate, commodities, artwork, private equity, and debt instruments. The tokenization of RWAs involves creating digital representations of these assets on a blockchain. Each token represents a fraction of the asset’s value, allowing it to be bought, sold, or traded like popular cryptocurrencies such as Bitcoin or Ethereum.

The process of tokenizing RWAs involves several steps: identifying a suitable asset for tokenization and determining its market value, developing digital tokens that represent ownership stakes in the asset using smart contracts on a blockchain, ensuring the tokenization process complies with relevant regulations in the jurisdictions where the asset and its investors are located, issuing the tokens to investors who can trade them on various blockchain-based platforms, and facilitating the trading of tokens on secondary markets, allowing investors to buy and sell their ownership stakes.

By applying tokenization to RWAs, several key benefits can be realized. Improved liquidity allows traditionally illiquid assets, such as real estate or private equity, to become more liquid through fractional ownership, enabling smaller portions of the asset to be traded. Enhanced transparency is provided by blockchain technology, which offers an immutable record of all transactions, ensuring a clear and auditable history of asset ownership and transfers. Tokenization can significantly reduce transaction costs by eliminating intermediaries and automating processes through smart contracts, making asset transactions more economical. Additionally, tokenization lowers the barriers to entry for investing in high-value assets, democratizing investment opportunities and allowing a broader audience to access and invest in previously inaccessible assets.

While the benefits of tokenizing RWAs are significant, several challenges must be addressed to ensure this technology’s successful implementation and widespread adoption. Navigating the complex regulatory landscape is one of the most important challenges. Different jurisdictions have varying regulations concerning digital assets, and compliance with these regulations is crucial. The lack of harmonized policies across regions can create barriers to the global adoption of tokenized assets. The digital nature of tokenized assets also makes them vulnerable to cybersecurity threats. Robust security measures, including advanced encryption, secure coding practices, and regular security audits, are necessary to protect against these risks. For tokenization to become mainstream, it must gain acceptance among various market participants, including investors, financial institutions, and regulators. Building a robust ecosystem that includes trusted tokenization platforms, secure exchanges, and knowledgeable service providers is essential.

The tokenization of private credit represents a groundbreaking development in the financial industry. Private credit refers to debt investments not issued or traded on public markets, including loans provided by private lenders, mezzanine financing, and other forms of non-bank lending. Traditionally, private credit has been relatively illiquid, with limited opportunities for investors to buy or sell their positions. Tokenization changes this dynamic by creating digital tokens representing claims on these private debt instruments. These tokens can be traded on secondary markets, providing liquidity to an asset class that has historically been difficult to exchange.

Tokenized private credit offers several benefits. Blockchain technology ensures that all transactions are recorded on a secure, immutable ledger, providing clear visibility into the history and status of debt instruments and reducing the risk of fraud. Using smart contracts in the tokenization process can automate various aspects of credit transactions, such as payment processing, interest distribution, and compliance checks, reducing manual intervention, lowering operational costs, and increasing efficiency. Tokenization allows for the fractional ownership of private credit instruments, enabling investors to purchase smaller portions of various debt assets and achieve greater diversification within their investment portfolios.

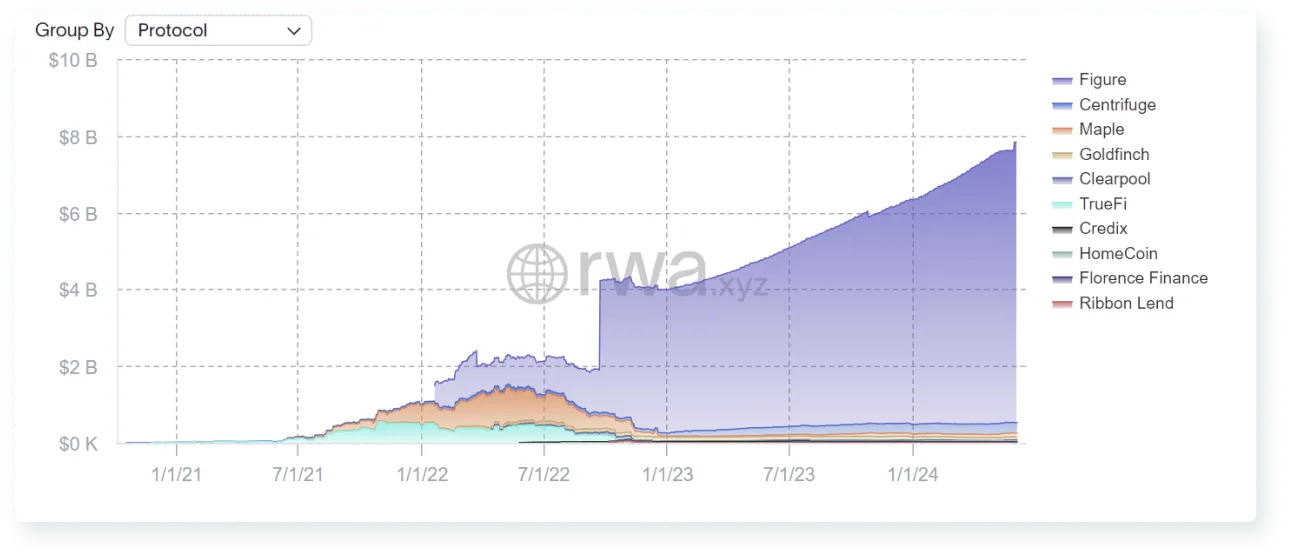

Several platforms are leading the way in tokenizing private credit, demonstrating the practical applications and benefits of this innovation. Centrifuge facilitates tokenizing real-world assets, including private credit, enhancing liquidity and providing access to decentralized finance (DeFi) markets. Goldfinch focuses on decentralized credit infrastructure, enabling the tokenization of private credit to increase capital access for borrowers globally. Credix offers a platform for the securitization and tokenization of private credit, aiming to bridge the gap between traditional finance and blockchain technology.

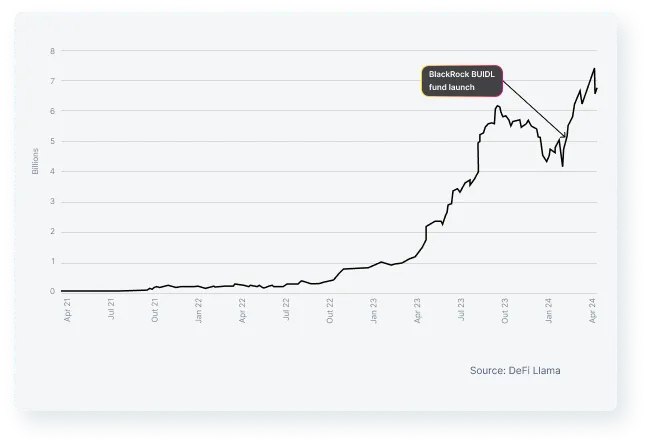

Adopting tokenization by major financial institutions demonstrates this technology’s practical applications and benefits in real-world scenarios. Santander Brazil has partnered with IBM to create a tokenization platform to enhance liquidity and market accessibility, focusing on tokenizing various assets, including credit card receivables and real estate. BTG Pactual, a leading investment bank in Latin America, has launched a tokenized Real-World Asset (RWA) investment fund focusing on Brazilian agribusiness assets, promoting diversification and creating new investment opportunities. Itaú Unibanco is testing the tokenization of fixed-income securities in collaboration with R3, aiming to improve the efficiency and accessibility of the fixed-income market. XP Investimentos has created a tokenization platform in partnership with ConsenSys, focusing on tokenizing assets such as startups and growing companies to democratize access to high-growth investment opportunities. BlackRock, the world’s largest asset manager, is exploring tokenization to enhance the efficiency of its investments in real-world assets, reflecting its commitment to innovation and belief in the potential of tokenization to transform asset management. The launch of BlackRock’s tokenized treasury fund BUIDL has sparked renewed interest in the sector, highlighting the growing recognition of tokenization’s benefits.

The tokenization of Real-World Assets (RWAs) is gaining momentum within the financial markets, driven by technological advancements and the growing recognition of its benefits. The financial landscape is currently influenced by ongoing quantitative tightening measures, which have led to a shift in investor sentiment towards risk aversion. In this environment, the popularity of stablecoins — cryptocurrencies pegged to stable assets like the US dollar — has been notable both within decentralized finance (DeFi) and in emerging real-world applications. Despite the current market conditions, several key factors are essential for the tokenization of RWAs to achieve critical mass. These include the development of practical and compelling applications, organic user demand, substantial on-chain liquidity, and favorable macroeconomic catalysts.

Total Value Locked (TVL) across real-world asset protocols

The tokenization of RWAs is poised to revolutionize asset markets by enhancing efficiency, transparency, and liquidity. Increased institutional participation, integration with DeFi platforms, enhanced regulatory frameworks, technological advancements, and the expansion into new asset classes are key trends likely to shape the future of this technology. The private credit sector has shown significant growth driven by the adoption of tokenization, with the market reaching approximately $8 billion by early 2024. This growth is primarily driven by innovative protocols such as Figure, Centrifuge, Maple, Goldfinch, Clearpool, and Credix. The increasing value of loans underscores a robust and positive trajectory for the broader adoption of tokenized assets.

The evolving financial landscape, marked by quantitative tightening measures and the growing significance of stablecoins, creates a conducive environment for the potential widespread adoption of Real-World Asset (RWA) tokenization. The proactive initiatives undertaken by leading financial institutions and the ongoing growth in the private credit sector signal a promising future for tokenized assets. By enhancing efficiency, transparency, and liquidity, tokenization is poised to revolutionize asset markets and promote a more inclusive and dynamic financial ecosystem. As regulatory frameworks evolve and technological advancements continue, the adoption of tokenized RWAs is likely to accelerate, offering significant benefits to investors, financial institutions, and the broader economy.

Private Credit Metrics

Authored by Cristiano Oliveira, Head of Research at Rivool Finance.

Tags

Private credit