Posted on March 11, 2024

Share:

While cryptocurrencies have captured headlines and public attention, tokenization has the potential to quietly reshape how we perceive and manage

tokenization-of-real-assets-unveiled-beyond-crypto-hype

Tokenization of Real Assets Unveiled: Beyond Crypto Hype

Against a backdrop of ever-evolving finance and digital technologies, tokenization emerges as a transformative force, transcending the initial overexposure around cryptocurrencies. While cryptocurrencies have captured headlines and public attention, tokenization has the potential to quietly reshape how we perceive and manage assets and the credit market.

In recent years, discussions around blockchain technology and digital assets have been dominated by the meteoric rise of Bitcoin and other cryptocurrencies. However, tokenization has been quietly maturing within this broader narrative and increasingly offers innovative solutions to long-standing challenges in finance, real estate, and various industries. In this context, it is essential to demystify tokenization, separating it from the shadows of cryptocurrency speculation and positioning it as a critical driver of digital transformation.

To understand how this is possible, it is relevant to be updated with some of the fundamental concepts of tokenization, examining its various types and unique applications. From tokenizing real-world assets to using smart contracts, it’s essential to understand the multifaceted nature of this technological phenomenon. In this way, it is possible to have the real dimension of tokenization’s advantages, paving the way for efficient and secure transactions, greater liquidity, and new avenues for investment. By dispelling myths, revealing their true potential, and moving beyond the hype of crypto and cryptocurrencies, there is a realm of innovation and possibilities that can reshape various markets and redefine the nature of ownership and exchange.

Initially, it is necessary to understand what tokenization is. The term “token” has a long history with varying connotations and definitions, sometimes making it difficult to pinpoint the exact meaning. In the context of the financial market, a token represents an asset in digital form, combined with transferable digital information and rights, all connected in a programmable and automated way. Tokens represent tangible or intangible physical assets, representing a stock or the entire asset. It can be anything from real estate, company stocks, bonds, or art. The token existing on the blockchain represents ownership of that asset. In this way, assets that were previously difficult to divide or trade can be easily managed and transacted.

The list of assets that can be tokenized depends on the categories that the tokens are pegged to. According to CVM Opinion №40 (October/2022), there are three categories of tokens. They are (1) Payment Token (cryptocurrency or payment token), (2) Utility Token (utility token), (3) Token referenced to a real asset (real asset-backed token) that are subdivided into four types: (3.1) security tokens, (3.2) stablecoins, (3.3) NFTs (non-fungible tokens) and (3.4) other assets subject to tokenization operations.

While blockchain technology often focuses on the growth of payment tokens, it is crucial to recognize that their most profound and potentially transformative application lies in tokenizing real assets. While cryptocurrencies have undeniably captured the imagination of investors and the public, their volatility and speculative nature have somewhat overshadowed the tangible and lasting impact that tokenizing real-world assets can offer. It is not an exaggeration to state that the use cases of real assets and blockchain can shape the future of the global economy.

These days, cryptocurrencies, in many eyes, can be associated with scams, overpriced JPEGs, untold token projects, or as-yet-uncharted territory. The tokenization of real-world assets could change that, making blockchain truly pervasive in society. The financial revolution and the innovation that comes with it have already opened up new possibilities previously inaccessible through traditional platforms.

And where does this potential come from? The fact that much of the world’s wealth today is locked in illiquid assets and, in this context, the gains that asset tokenization can generate are significant in several dimensions, such as:

Liquidity and fractional ownership: Real assets like real estate are typically illiquid and require significant capital to invest. Tokenization divides these assets into tradable digital tokens, allowing for fractional ownership. This fractionation makes it easier for investors to buy and sell smaller portions of these assets, increasing liquidity in previously illiquid markets.

Accessibility to global investors: Tokenization breaks down geographical barriers, allowing investors worldwide to participate in real asset markets. Investors can purchase tokens that represent ownership of real assets without the limitations of physical proximity.

Portfolio diversification and expansion: Tokenization allows investors to diversify their portfolios by investing in various real assets that were previously out of reach due to high entry costs. This diversification can help spread risk and optimize investment strategies.

Efficiency in transactions and transfer of ownership: Blockchain-based tokenization streamlines the buying, selling, and transferring ownership of real assets. It can reduce the complexities and time required for transactions, including paperwork, intermediaries, and administrative processes, leading to faster and more cost-effective transactions.

Lower costs: Tokenization can significantly reduce the transaction costs of buying, selling, and holding real assets. This includes costs related to intermediaries, legal fees, and administrative expenses.

Increased transparency and security: Blockchain technology offers transparency and immutability. The ownership history and transaction records of real assets stored on a blockchain are secure and transparent, reducing the chances of fraud or disputes.

New investment and innovation opportunities: Tokenization introduces new products and investment opportunities to real asset markets. For example, investors can invest in fractions of a high-value property, benefitting from potential appreciation without investing substantial capital.

Automated compliance and governance: Smart contracts on tokenized real assets can automate compliance measures, ensuring that transactions comply with predefined regulations and rules. This can streamline regulatory compliance and governance processes.

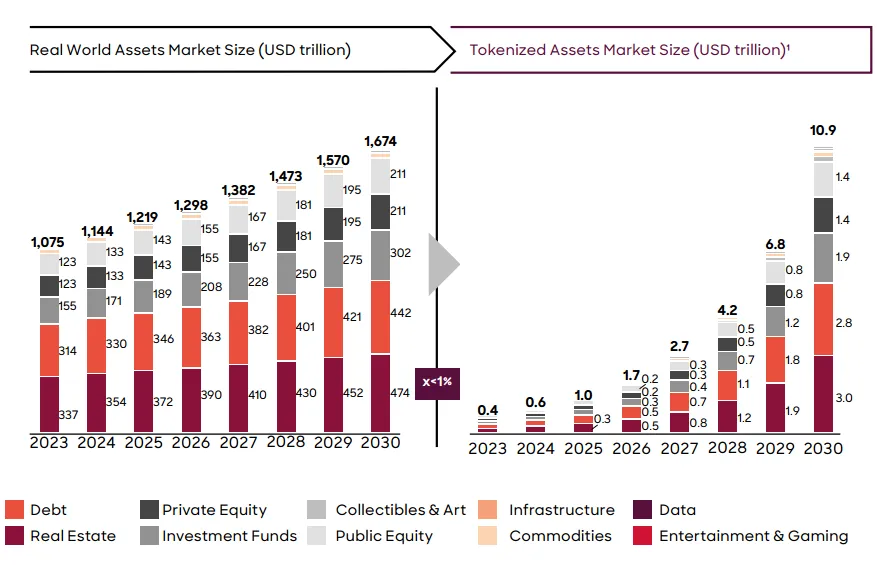

These new possibilities by tokenizing real assets allow us to glimpse an optimistic scenario regarding its application. For example, a recent report by consultancy Roland Berger states that the tokenization of real assets will grow to become a market valued at least USD 10 trillion by 2030, representing a 40-fold increase in the value of tokenized assets between 2022 and 2030 since the current value would be around USD 300 billion.

Source: Roland Berger

As seen in the chart, the debt market has the potential to reach almost USD 3 trillion by the end of this decade. In this market, in particular, tokenization has the potential to revolutionize the way credit instruments are issued, traded, and managed. In this sense, several initiatives and companies are exploring or implementing tokenization within the credit market for various purposes:

Tokenized securities and debt instruments: Companies are exploring the tokenization of traditional securities and debt instruments, enabling fractional ownership and trading on blockchain-based platforms. This can potentially increase liquidity and accessibility for investors.

Peer-to-peer lending platforms: Some platforms use tokenization to create peer-to-peer lending systems where loans are tokenized, allowing for more direct transfer and fractional ownership of lending assets.

Credit Derivatives and Structured Products: Tokenization can create credit derivatives and structured products, enabling more accessible and efficient trading and management of these complex financial instruments.

Credit Score and Identity Verification: Blockchain-based tokenization can be used to store and manage individuals’ credit scores and identities securely, providing a more reliable and tamper-resistant system for credit assessment and verification.

Debt Securitization: Tokenization can streamline the debt securitization process, making it more transparent and accessible to more investors.

Decentralized finance (DeFi) credit protocols: Within the decentralized finance space, several protocols explore tokenization for lending and borrowing, allowing users to access credit and lending services without traditional financial intermediaries.

In other words, it is already possible to observe many tokenization applications in the credit market that can improve efficiency, accessibility, transparency, and liquidity while reducing the costs associated with traditional credit instruments. As such, the true power of tokenization lies in its ability to revolutionize how we perceive, transact, and manage assets.

From the tokenization of debts to the execution of smart contracts, the transformative impact is undeniable. The promise of greater liquidity, greater security, and streamlined transactions positions tokenization as a formidable force shaping the future of various industries, including the credit market. As the concepts and applications of blockchain and tokenization become more widespread, it becomes apparent that while cryptocurrencies have played a key role in bringing blockchain to the forefront, the tokenization of real assets holds the promise of sustainable and tangible change, and as the potential growth of tokenization becomes more evident to everyone, the financial market is moving towards a more transparent, efficient, and inclusive digital economy through blockchain technologies.

Authored by

Cristiano Oliveira

Associate Professor at the Federal University of Rio Grande — FURG andHead of Research at Rivool Finance

Tiago Piassum Theodoro

Founder of Rivool Finance

Tags

Private credit