Posted on June 19, 2024

Share:

Two of the most crucial financial instruments in the Brazilian agribusiness sector are CPRs (Certificados de Recebíveis do Agronegócio) and CDCAs (Cer

tokenizing-agricultural-receivables-a-new-era-for-cprs-and-cdcas

Tokenizing Agricultural Receivables: A New Era for CPRs and CDCAs

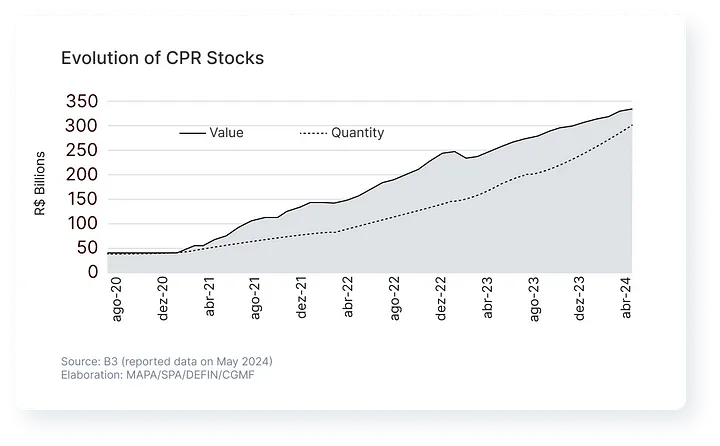

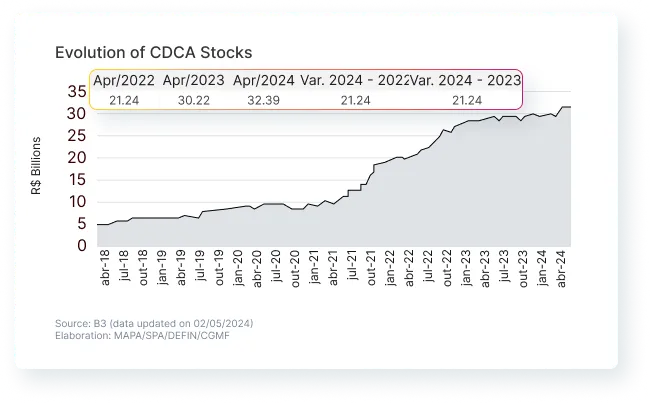

Two of the most crucial financial instruments in the Brazilian agribusiness sector are CPRs (Certificados de Recebíveis do Agronegócio) and CDCAs (Certificados de Depósito de Créditos Agrícolas). These instruments play a critical role in the Brazilian agribusiness financing ecosystem, which has shown amazing growth over the last three years. They effectively bridge the gap between producers’ capital needs and financial markets’ offerings, thus supporting the sector’s growth and sustainability.

CPRs (Certificados de Recebíveis do Agronegócio) are fixed-income securities representing credit rights from financing operations conducted with Brazilian agribusiness. They are issued by financial institutions, development agencies, and other entities authorized by the National Securities Commission (CVM). The debtors are agribusiness companies, including rural producers, cooperatives, and agro-industries. The collateral for CPRs consists of receivables from agribusiness credit operations, such as financing for costs, investments, and commercialization. The yield on these securities is predetermined and generally linked to market indicators, like interest rates or agricultural commodity price indices. CPRs are traded on the stock exchange, allowing investors to buy and sell anytime.

CDCAs (Certificados de Depósito de Créditos Agrícolas) are another type of fixed-income security representing credit rights from financing operations within Brazilian agribusiness. Issued by banks and other financial institutions authorized by the CVM, the debtors for CDCAs are also agribusiness companies, such as rural producers, cooperatives, and agro-industries. These securities are backed by receivables from agribusiness credit operations, including financing for costs, investments, and commercialization. Like CPRs, the yield on CDCAs is predetermined and generally linked to market indicators, such as interest rates or agricultural commodity price indices. CDCAs are also traded on the stock exchange, providing investors with liquidity through the ability to buy and sell these securities at any time.

The advantages of CPRs and CDCAs are significant. They offer portfolio diversification and exposure to the agribusiness market, the most prominent sector of the Brazilian economy. Most importantly, they provide the potential for regular passive income, a key investor benefit.

Nonetheless, CPRs and CDCAs also present certain drawbacks. They have lower liquidity than government-issued fixed-income securities, and there is a credit risk, as the payment depends on the debtor’s repayment capacity. Moreover, their income can be volatile due to changes in agricultural commodity prices and climate issues.

Besides, despite their importance, CPRs and CDCAs exhibit several inefficiencies. For one, securing financing through these instruments can be cumbersome and time-consuming, often requiring extensive paperwork and numerous intermediaries. This bureaucracy delays access to necessary funds and increases costs for producers. Additionally, the liquidity of these instruments can be limited, as they are typically traded on traditional exchanges, which might not always offer optimal conditions for timely and efficient transactions. Furthermore, a significant credit risk is involved, as the payment depends on the debtor’s financial stability, which can be volatile given the nature of the agribusiness sector.

Tokenization can facilitate producers’ access to credit by allowing producers to negotiate their receivables directly in the capital market without the need for traditional intermediaries such as banks. This can reduce costs and bureaucracy while expediting the process of obtaining resources. Besides, tokenization enables producers to diversify their funding sources beyond banks and development agencies, allowing them to attract capital from institutional and individual investors. This diversification can lead to better interest rates and payment conditions. Another important advantage of tokenization is that blockchain technology ensures the transparency and traceability of token transactions, which can increase investor confidence and help producers better manage the flow of resources. So, tokenization can open the door to new business models in agribusiness, such as crowdfunding platforms to finance specific projects or the creation of loyalty tokens to reward customers.

For investors, tokenization offers them access to a new type of financial asset with attractive potential returns and portfolio diversification. With tokenization, investors can invest in fractions of CPRs and CDCAs, reducing the minimum investment amount and democratizing access to these assets. Trading tokens on decentralized exchanges can enhance the liquidity of investments, allowing investors to buy and sell their tokens more easily. Tokenization can lower transaction and intermediation costs, making investments more accessible and profitable for investors. Furthermore, blockchain technology ensures the security of assets, protecting against fraud and data manipulation.

In summary, the inefficiencies of traditional financial instruments like CPRs and CDCAs can be mitigated through tokenization. This innovative approach offers numerous benefits for producers and investors, leading to a more efficient, transparent, and accessible financial ecosystem in the agribusiness sector. Besides the advantages mentioned above, the tokenization of CPRs and CDCAs can also contribute to increased financial inclusion in agribusiness by facilitating access to credit and diversifying funding sources. This benefits small and medium-sized producers who often struggle to access traditional credit. Moreover, tokenization can foster the development of the capital market by attracting new investors and diversifying available products. Additionally, blockchain technology can enhance the efficiency and transparency of the agribusiness credit market, benefiting both producers and investors.

Authored by Cristiano Oliveira, Head of Research at Rivool Finance

Tags

Private credit