Posted on September 26, 2023

Share:

Accessing the Latin American agricultural credit market is a journey fraught with challenges: it’s expensive, time-consuming, and often complex.

unlocking-investment-opportunities-in-latin-american-agribusiness

Unlocking Investment Opportunities in Latin American Agribusiness

Breaking Down Barriers in the Agricultural Credit Market

Accessing the Latin American agricultural credit market is a journey fraught with challenges: it’s expensive, time-consuming, and often complex.

According to S&P Global, the returns from rural credit in Brazil and Latin America consistently outperform those in the USA and Eurozone. Yet, despite this substantial potential, numerous barriers have historically deterred global investors from exploring the region’s opportunities.

So, how do we bridge this gap and connect global investors with the thriving Latin American agricultural sector?

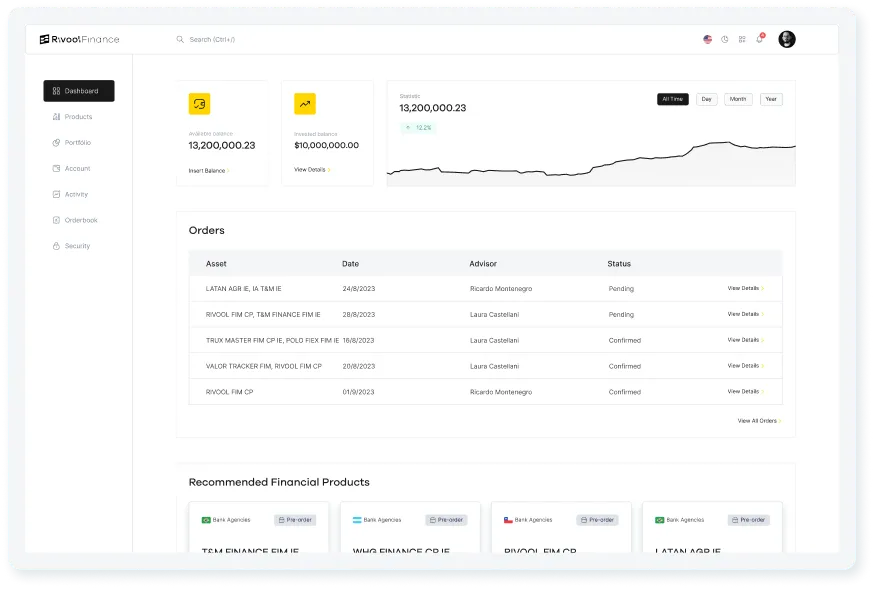

Rivool Finance: Pioneering a Pathway

Rivool Finance’s ecosystem has been meticulously designed to serve as a bridge between international investors and the originators/managers of private credit assets in Latin America’s agricultural sector. And it all begins with Brazil, a market with tremendous growth potential.

Our platform is not just about access; it’s about empowerment.

Unlocking New Investment Horizons

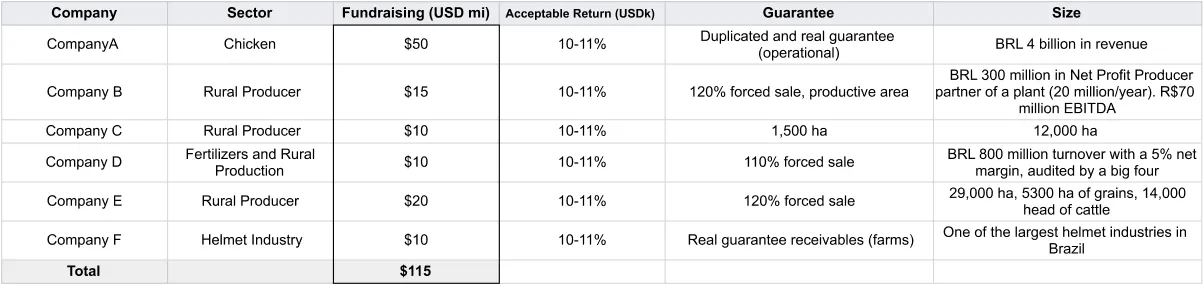

At Rivool Finance, we empower investors with unprecedented access to the private credit funds of Brazil’s agribusiness sector, which constitutes nearly one-third of Brazil’s GDP. Our extensive origination channel boasts 300+ trusted partners, providing an impressive Origination Capacity of $10 billion.

A Collaborative Partnership

For investment managers, Rivool Finance is more than just a platform; we’re your trusted business collaborator. We facilitate the flow of foreign capital into Brazil’s thriving private credit market.

Unlike conventional relationships within the institutional investment realm, we maintain clear separation between our operational policies and asset management, ensuring the safety of global investors while preserving the platform’s integrity.

Connect with us to explore new investment horizons: https://rivool.finance/.

Tags

Private credit